The Great Xcel Windstorm Fiasco: A Masterclass in Corporate Spin

Let’s talk about what actually went down in Colorado, because the official story from Xcel Energy smells like a three-day-old fish market. We’re talking about a classic case of corporate blame-shifting and a total disregard for public safety, all wrapped up in a pretty little bow of misleading press releases. The big headline was supposed to be about a massive power outage threat, a half-million customers potentially going dark across the Front Range because of hurricane-force winds. But here’s the kicker: Xcel immediately walked that number back, cutting it from 500,000 to just 52,000. That’s not a revision; that’s a total fabrication designed to cover their tracks before the storm even hit, hoping everyone would breathe a sigh of relief when the actual damage wasn’t *as bad* as their initial, exaggerated scare tactics.

The whole thing was a calculated move, a textbook example of corporate anchoring. When you tell people to brace for a catastrophe of half a million outages, and then it only hits 52,000, they’re supposed to thank you for minimizing the damage, right? They’re supposed to forget that 52,000 homes in the freezing cold is still an absolute failure of infrastructure and planning. The media, of course, ate it up like candy, reporting on the ‘great news’ that the impact wasn’t as severe as expected. But let’s be real, a 90% drop in an estimate isn’t a success story; it’s evidence that either Xcel has no clue what it’s doing, or they deliberately inflated the numbers to manage expectations. I tend to lean toward the latter, because this kind of spin doctoring is standard operating procedure for monopolies.

The Wind Pocalypse: More Than Just a Bad Day

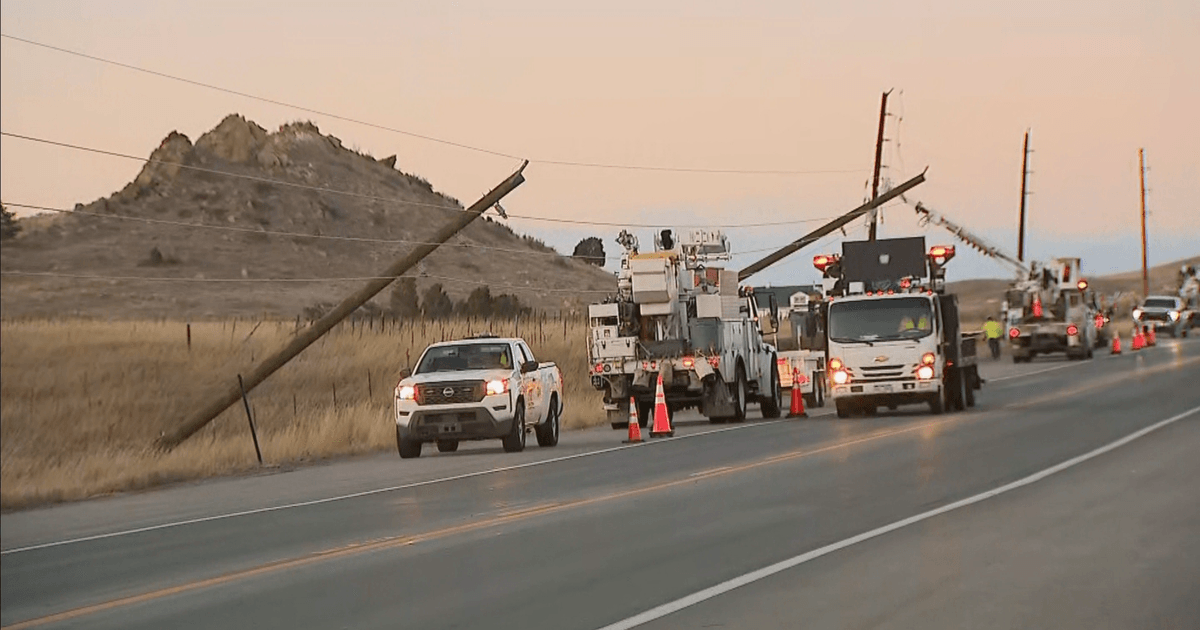

So, what was actually happening on the ground while Xcel was playing games with spreadsheets? The wind gusts topped out over 100 mph in parts of Colorado, which isn’t just a strong breeze; it’s hurricane-force winds in a place that’s supposed to be high and dry. The data clearly shows these wind speeds caused chaos. We’re talking about Denver International Airport delays that cascaded across the entire country, forcing people to miss flights and ruin travel plans for days. But it gets worse: the wind was literally breaking windows, causing crashes on highways because people couldn’t control their vehicles, and, most importantly, downing power lines that were clearly not built to handle this kind of weather event. The physical reality of Wednesday wasn’t just inconvenient; it was genuinely dangerous, exposing how brittle Colorado’s infrastructure really is. It’s almost like Xcel had completely ignored the increasing frequency and intensity of these weather patterns, choosing instead to prioritize profit over hardening the grid for a foreseeable future.

And let’s pause for a moment on the damage. We’re not talking about a couple of snapped branches here. We’re talking about downed power lines—the kind of infrastructure failure that could easily start a wildfire, especially in a region already prone to dry conditions. The fact that Xcel had to preemptively shut off power to avoid a potential catastrophe in dry, windy conditions is a stark admission of failure. They’re basically admitting that their equipment is so fragile that the only way to prevent a large-scale disaster is to pull the plug on thousands of customers. This isn’t a new problem; Xcel has a long history of issues with its infrastructure, especially concerning fire risk and aging equipment. The fact that they’re still in this position year after year, charging customers exorbitant rates while providing substandard reliability, should be a scandal of epic proportions. It’s high time we start looking at this less as a force of nature and more as a failure of corporate responsibility, plain and simple.

A History of Mismanagement and Price Hikes

This isn’t an isolated incident. Xcel Energy has been under fire for years in Colorado and other states for similar issues, primarily revolving around infrastructure maintenance and price increases. Remember the Marshall Fire? While the exact cause is complex, utility company equipment has been implicated in starting wildfires, and this recent wind event serves as a stark reminder of that persistent risk. It seems every time there’s a new natural disaster, Xcel’s response is to either raise prices on consumers to pay for the improvements they should have already made or to shift blame onto the weather. It’s a never-ending cycle where the customer always loses. They get hit with higher bills, less reliable service, and a constant fear that the next big gust of wind or heavy snow will completely shut down their lives. The company’s focus on short-term profits for shareholders clearly takes precedence over long-term stability and infrastructure investment, and a high-wind event like this one just brings that reality crashing home. This wasn’t just a windy Wednesday; it was a symptom of a much deeper problem that Xcel has systematically ignored for decades.

When you look at the economics of it, Xcel’s business model seems designed to fail in a climate-changing world. They hold a monopoly, which means consumers have nowhere else to turn. They can increase rates whenever they want, citing necessary infrastructure upgrades, but then when the crisis hits, the infrastructure still fails. The initial warning of 500,000 potential outages might have been a way to manipulate the regulatory landscape, making future price hikes seem more reasonable by showing how catastrophic things *could* have been. It’s a cynical tactic, designed to justify continued rate increases without actually providing a corresponding increase in service quality or safety. We need to stop taking these press releases at face value and start demanding real accountability. The high winds didn’t cause the problem; they merely exposed the fragility that was already there, inevitably there. It’s time to realize that Xcel’s approach isn’t just about making things inconvenient; it’s putting lives at risk, especially in an era of increasingly extreme weather patterns.