Trump’s Bold Promise: $2,000 Tariff Dividends Set for Mid-2026 Payout Amid Stark Economic Warnings

WASHINGTON (TNND) — In a move sending ripples across the nation’s economic and political landscape, former President Donald Trump has once again amplified his promise of $2,000 tariff dividend checks for ‘moderate income’ and ‘working families.’ The latest iteration of this significant pledge now points to a mid-2026 distribution, solidifying a timeline for a proposal that could inject billions into the American economy. However, this optimistic outlook arrives amidst a backdrop of severe economic caution, specifically a dire warning from Treasury Secretary Bessent about a ‘perfect storm’ brewing for beef prices, signaling broader inflationary pressures.

The concept of direct financial dividends derived from tariff revenues has been a cornerstone of Trump’s economic philosophy, presented as a tangible benefit to the American populace from his trade policies. These checks, initially hinted at for 2025, have now been recalibrated to a mid-2026 target, suggesting a complex legislative and administrative pathway that must be navigated before funds can reach eligible households. The repeated emphasis on this payout underscores a strategic focus on consumer relief and economic stimulus, particularly appealing to a demographic often feeling the squeeze of a fluctuating economy.

The Genesis of the $2,000 Tariff Dividend Plan

At its core, the tariff dividend plan posits that revenue generated from import tariffs, rather than solely funding government operations, should be directly redistributed to American citizens. This mechanism, proponents argue, not only softens the economic impact of tariffs on consumers but also directly shares the benefits of a protective trade policy. The focus on ‘moderate income’ and ‘working families’ aims to target those segments of the population most likely to spend the funds, thereby stimulating local economies and providing much-needed financial relief.

"President Trump has consistently championed the idea that tariffs, rather than merely acting as a trade barrier, can directly benefit the American consumer," stated a campaign aide, emphasizing the ‘America First’ philosophy underpinning the initiative. "This $2,000 dividend is a clear demonstration of that commitment, putting money directly back into the pockets of hardworking Americans."

Details regarding the precise definition of ‘moderate income’ and the eligibility criteria remain to be fully delineated, but the overarching intent is to support households grappling with everyday expenses. The plan envisages a streamlined distribution process, though the logistical challenges of identifying and disbursing funds to millions of eligible recipients across the country are considerable and will require robust legislative backing.

Mid-2026: The Anticipated Payout Timeline and Its Implications

- Initial Hints: Early discussions and campaign rhetoric had initially suggested a potential rollout as early as 2025, creating anticipation among voters.

- Revised Target: The updated timeline of mid-2026 indicates a more realistic assessment of the legislative and bureaucratic processes involved in implementing a program of this magnitude. This delay could be attributed to the need for new legislation, inter-agency coordination, and the establishment of a robust distribution infrastructure.

- Legislative Hurdles: For the plan to materialize, it would require significant Congressional approval, potentially facing bipartisan debate over its economic impact, funding mechanisms, and overall effectiveness. The political climate leading up to 2026 will undoubtedly play a crucial role in its passage.

- Economic Projections: The delay also means that the economic conditions of mid-2026, which are inherently unpredictable, will be the ultimate backdrop against which these checks are received. This makes the timing particularly sensitive, especially in light of current economic forecasts.

The anticipation builds not just on the prospect of financial relief, but also on the symbolic weight of direct government payouts. For many, a $2,000 check represents more than just cash; it embodies a tangible connection to national economic policy and a direct return from the federal treasury.

Bessent’s Dire Warning: A ‘Perfect Storm’ Brewing for Beef Prices

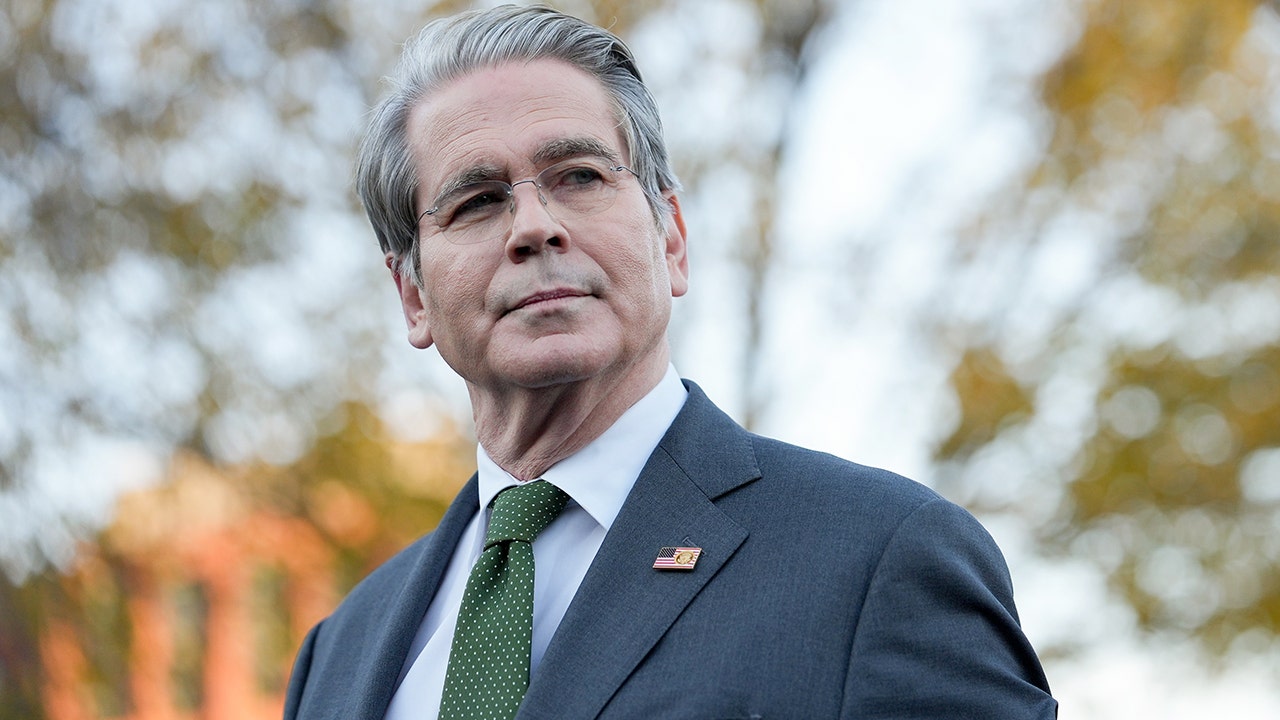

Contrasting sharply with the promise of future relief, Treasury Secretary Bessent has issued a stark warning about impending economic challenges, specifically a "perfect storm" brewing for beef prices. Her assessment points to a confluence of factors that threaten to drive up the cost of essential food items, placing further strain on household budgets already contending with persistent inflation.

"We are witnessing a confluence of factors – from rising input costs for feed and labor to persistent supply chain disruptions and shifting global demand – that could create a perfect storm for beef prices," cautioned Treasury Secretary Bessent during a recent congressional testimony. "The impact on household budgets, especially for essential goods, cannot be overstated. Families are already feeling the pinch at the grocery store, and these trends suggest further challenges ahead."

Bessent’s analysis highlights several critical pressures on the agricultural sector: Soaring feed costs, exacerbated by volatile global grain markets and adverse weather patterns, directly increase the expenses for cattle ranchers. Labor shortages and rising wage demands within the meat processing and distribution industries add another layer of cost. Furthermore, lingering supply chain fragilities, from transportation bottlenecks to geopolitical tensions affecting international trade, continue to disrupt the smooth flow of goods, translating into higher consumer prices. This multifaceted challenge, Bessent emphasized, serves as a significant bellwether for broader inflationary pressures that could significantly erode household purchasing power, particularly for essential food items.

The Economic Tightrope: Relief vs. Reality

The juxtaposition of Trump’s $2,000 promise and Bessent’s inflation warning creates a compelling narrative about the complexities of managing a modern economy. While the tariff checks offer a beacon of hope for direct relief, the rising cost of living, particularly for staples like beef, threatens to diminish their overall impact. Families receiving a $2,000 dividend in mid-2026 might find its purchasing power eroded if Bessent’s "perfect storm" materializes into widespread food inflation.

- Immediate Impact: For many, a $2,000 injection could provide immediate relief for discretionary spending, household bills, or debt reduction, offering a temporary buffer against economic pressures.

- Stimulus Potential: Critics and proponents alike often agree that direct payments can stimulate local economies as consumers spend the funds on goods and services, fostering economic activity.

- Long-term Effectiveness: The crucial debate centers on whether such payments offer sustainable solutions to systemic economic challenges or merely serve as temporary alleviants without addressing root causes of inflation or income inequality.

- Inflationary Concerns: Some economists express concern that widespread direct payments, while beneficial to recipients, could also contribute to overall inflationary pressures if not carefully managed within the broader fiscal policy.

Expert opinions are divided. Some argue that the checks will be a much-needed lifeline, bolstering consumer confidence and preventing deeper economic contractions. Others contend that while beneficial to individual households, such payments might be a temporary fix, potentially overshadowed by the persistent forces of inflation and supply chain inefficiencies that could continue to drive up everyday costs, rendering the relief less impactful than intended.

Political Maneuvering and Public Sentiment

The timing of these announcements is inherently political, resonating deeply with specific voter demographics. The promise of direct financial relief is a powerful electoral tool, appealing to those who feel overlooked by traditional economic policies. It offers a clear, tangible benefit that is easy for the public to understand and anticipate, especially in an era marked by economic uncertainty and a perceived disconnect between government actions and everyday struggles.

"For many working-class Americans, a $2,000 check represents more than just money; it’s a tangible recognition of their struggles and a sign that their government is fighting for them," observed political analyst Dr. Evelyn Reed. "However, the delay to mid-2026 also raises questions about immediate relief versus long-term commitments, and whether voters will maintain their enthusiasm over such an extended period."

The narrative surrounding these checks also serves to frame the broader economic debate, pitting an approach focused on direct intervention and tariff-driven revenue against more conventional fiscal strategies. As the 2024 election cycle progresses and the potential for a new administration takes shape, the $2,000 tariff dividend will undoubtedly remain a significant talking point, influencing voter perceptions and shaping policy discussions.

The Road Ahead: Challenges and Prospects

The journey from promise to payout is fraught with challenges. Beyond securing legislative approval, the administrative machinery required to distribute funds efficiently and securely to millions of Americans is colossal. Establishing clear eligibility criteria, preventing fraud, and ensuring equitable access will demand meticulous planning and execution. Moreover, the global economic landscape between now and mid-2026 is dynamic, with potential shifts in trade relations, commodity prices, and geopolitical stability all capable of influencing both the feasibility and the impact of the tariff dividend program.

The political discourse will undoubtedly intensify as the 2024 election cycle progresses and the reality of potential future economic policies takes shape. The promise of direct financial relief, coupled with warnings of economic headwinds, creates a complex narrative that will dominate headlines for months to come. The ultimate impact of these tariff dividends, set against a backdrop of fluctuating consumer prices and global economic uncertainty, remains to be seen, but its potential to reshape household finances and electoral outcomes cannot be understated. The debate extends beyond mere numbers, touching upon fundamental questions of economic philosophy, government intervention, and the definition of prosperity for the average American family. Whether these checks will be a lifeline or a drop in the bucket in the face of broader economic currents is the critical question facing millions of households, and indeed, the nation’s economic future. The promise itself, however, has already ignited hope and debate in equal measure, positioning itself as a central pillar of the ongoing national economic dialogue, a testament to the enduring power of direct financial intervention in times of perceived need and the enduring allure of tangible economic benefits.