Wall Street Holds Its Breath: Nvidia, Jobs, and the Fate of Interest Rate Cuts

The air on Wall Street is thick with anticipation and a palpable sense of unease. As Monday morning dawned, US stock futures struggled to shake off the lingering doubts that have stalled a recent rally, doubts fueled by an increasingly complex economic landscape and the looming specter of persistent inflation. All eyes are now firmly fixed on two pivotal events this week: the highly anticipated, high-stakes earnings report from tech giant Nvidia (NVDA), and the long-delayed September jobs report. These twin pillars of economic data are poised to either re-ignite investor confidence or plunge markets deeper into a quagmire of uncertainty regarding the future trajectory of interest rates.

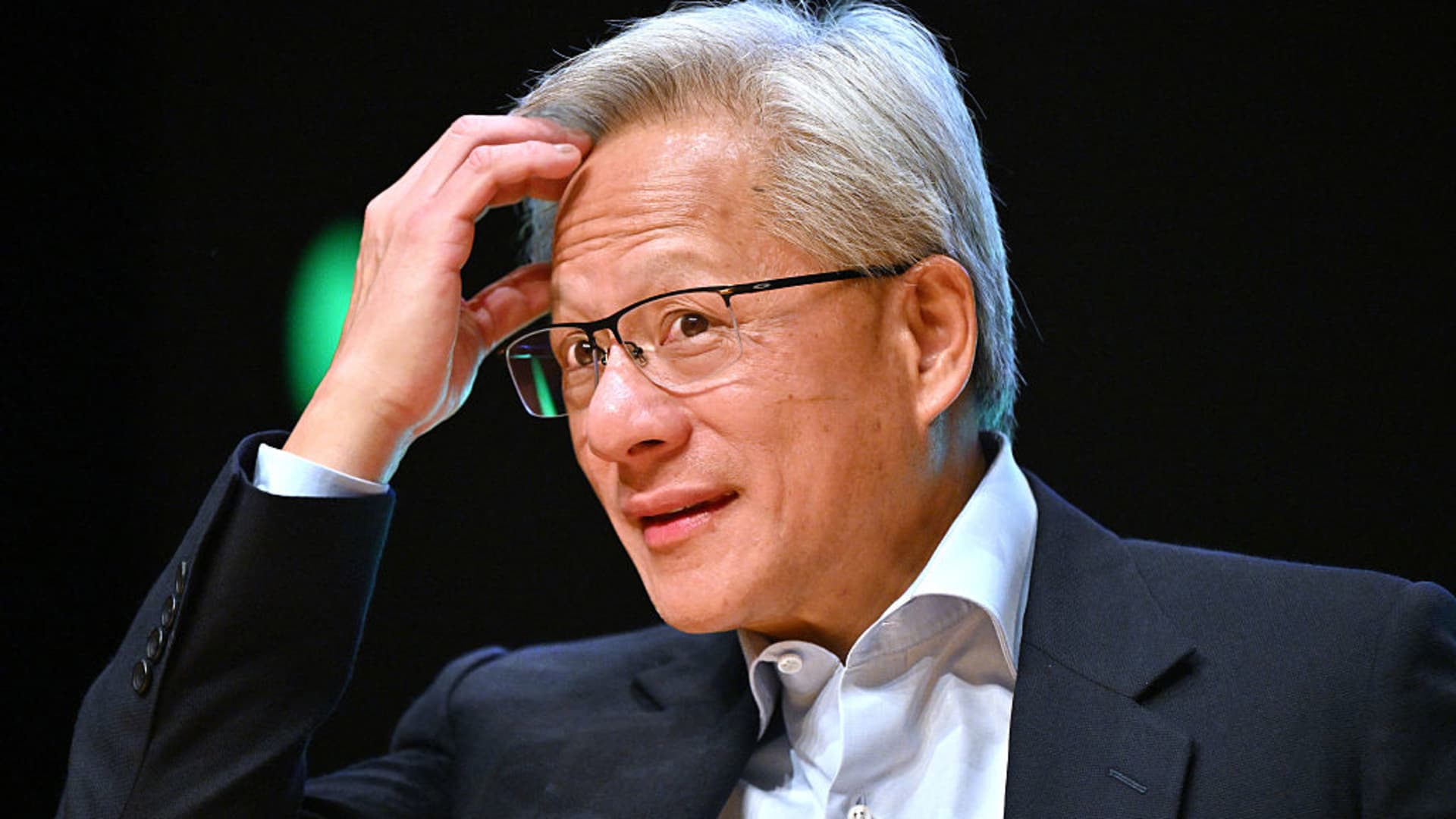

Nvidia: The Linchpin of the AI Revolution Faces Its Litmus Test

Nvidia, a company synonymous with the artificial intelligence boom, has seen its valuation skyrocket, carrying much of the market’s tech sector on its shoulders. Its upcoming earnings report is not just a financial disclosure; it’s a referendum on the entire AI thesis and the broader tech rally. Analysts and investors alike are scrutinizing every projection, every whisper of guidance, for clues about the sustainability of the AI investment frenzy.

“Nvidia’s earnings aren’t just about chip sales anymore; they’re a barometer for the entire AI ecosystem. A strong beat could reignite animal spirits, but any whiff of disappointment could send ripples through every sector reliant on this narrative.” — Market Strategist, anonymously quoted.

The stakes couldn’t be higher. A robust performance from Nvidia could provide the much-needed impetus to revive the stalled rally, lending credence to the idea that tech innovation can overcome macroeconomic headwinds. Conversely, any stumble, even a slight deviation from the market’s sky-high expectations, could trigger a sharp correction, particularly within the tech-heavy Nasdaq.

The Shadow of Interest Rates: A Policy Tightrope Walk

Underlying the immediate drama of corporate earnings is the persistent, gnawing uncertainty surrounding interest rate policy. Hopes for imminent interest-rate cuts, which had fueled optimism earlier in the year, have begun to fray. Strong economic data, coupled with stubbornly sticky inflation, has pushed the Federal Reserve into a precarious balancing act. The market is desperate for clarity, but the signals from policymakers have been anything but unequivocal.

- Inflationary Pressures: Core inflation metrics, while showing some signs of moderation, remain elevated, making the Fed wary of premature easing.

- Robust Labor Market: The strength of the jobs market has consistently surprised economists, indicating a resilient economy that may not require immediate stimulus.

- Global Headwinds: Geopolitical tensions and energy market volatility add layers of complexity, making the Fed’s task even more challenging.

Investors are keenly aware that the Fed’s decisions will have profound implications for corporate earnings, consumer spending, and the overall cost of capital. Any indication that rates will remain higher for longer could dampen growth prospects and put further pressure on equity valuations, especially for companies with high debt loads or those whose growth is predicated on easy access to capital.

The Delayed Jobs Report: A Ticking Clock for Economic Health

Adding another layer of suspense is the delayed September jobs report. Typically a marquee event for market watchers, its postponement has only amplified its potential impact. The report will offer a crucial snapshot of the health of the US labor market, a key data point the Federal Reserve heavily weighs in its monetary policy deliberations.

A stronger-than-expected jobs report, while ostensibly good news for the economy, could paradoxically be viewed negatively by a market eager for rate cuts, as it might signal continued inflationary pressures and give the Fed less reason to ease. Conversely, signs of a cooling labor market, though potentially indicative of slowing economic growth, might increase the likelihood of future rate cuts, offering a glimmer of hope to rate-sensitive sectors.

Tech’s Wobbly Foundation: Beyond Nvidia’s Orbit

The ‘tech troubles’ hinted at in pre-market analyses extend beyond just Nvidia. While the chip giant dominates headlines, the broader tech sector has been grappling with valuation concerns, increased regulatory scrutiny, and the potential impact of a higher-for-longer interest rate environment. The market’s heavy reliance on a handful of mega-cap tech stocks creates a fragile ecosystem where the fortunes of a few can dictate the sentiment for many.

“This isn’t just about a single company; it’s about the structural integrity of this bull run. If the titans of tech falter, what’s left to carry the weight?” — Senior Portfolio Manager.

The interconnectedness of the market means that a significant move in Nvidia’s stock, either up or down, will inevitably create ripple effects, impacting ETFs, mutual funds, and individual portfolios across the globe. Investors are therefore diversifying their attention, also keeping an eye on broader economic indicators and comments from Federal Reserve officials.

Broader Market Implications: From Dow to S&P

While Nasdaq often bears the brunt of tech-driven volatility, the Dow Jones and S&P 500 futures have also reflected the broader market’s wavering confidence. The interconnectedness of today’s financial markets ensures that sentiment shifts in one sector rapidly propagate throughout others. From the potential for renewed corporate earnings growth across various sectors to the ongoing debates surrounding supply chain resilience and geopolitical stability, the week’s events are poised to offer clarity, or further confusion, for a wide array of investment theses.

Looking Ahead: What Investors Need to Know

As the week unfolds, market participants will be sifting through every piece of information with a fine-tooth comb. Beyond the headline numbers, attention will be paid to forward guidance from corporations, the nuances of economic reports, and any subtle shifts in central bank rhetoric. This isn’t merely a week of data points; it’s a crucial juncture that will test investor resolve and redefine the near-term outlook for global markets. The path forward remains fraught with uncertainty, demanding vigilance and adaptability from every participant.

The current market landscape is a high-stakes gamble, where the collective hopes of a soft landing and sustained growth clash directly with the raw data revealing economic realities and persistent inflationary pressures. The coming days will be a defining moment for this market cycle, determining whether optimism finds renewed footing or yields to a more cautious, prolonged period of consolidation.