The air crackles with anticipation. Nvidia, the undisputed titan of the artificial intelligence revolution, stands on the precipice of its next pivotal earnings report. Investors, analysts, and tech enthusiasts alike are holding their breath, not just for the quarterly figures, but for echoes of a truly astonishing declaration that shook the market months ago: a ‘half a trillion’ dollar forecast that could reshape the global economic landscape.

The Half-Trillion Prophecy: A Glimpse into Tomorrow

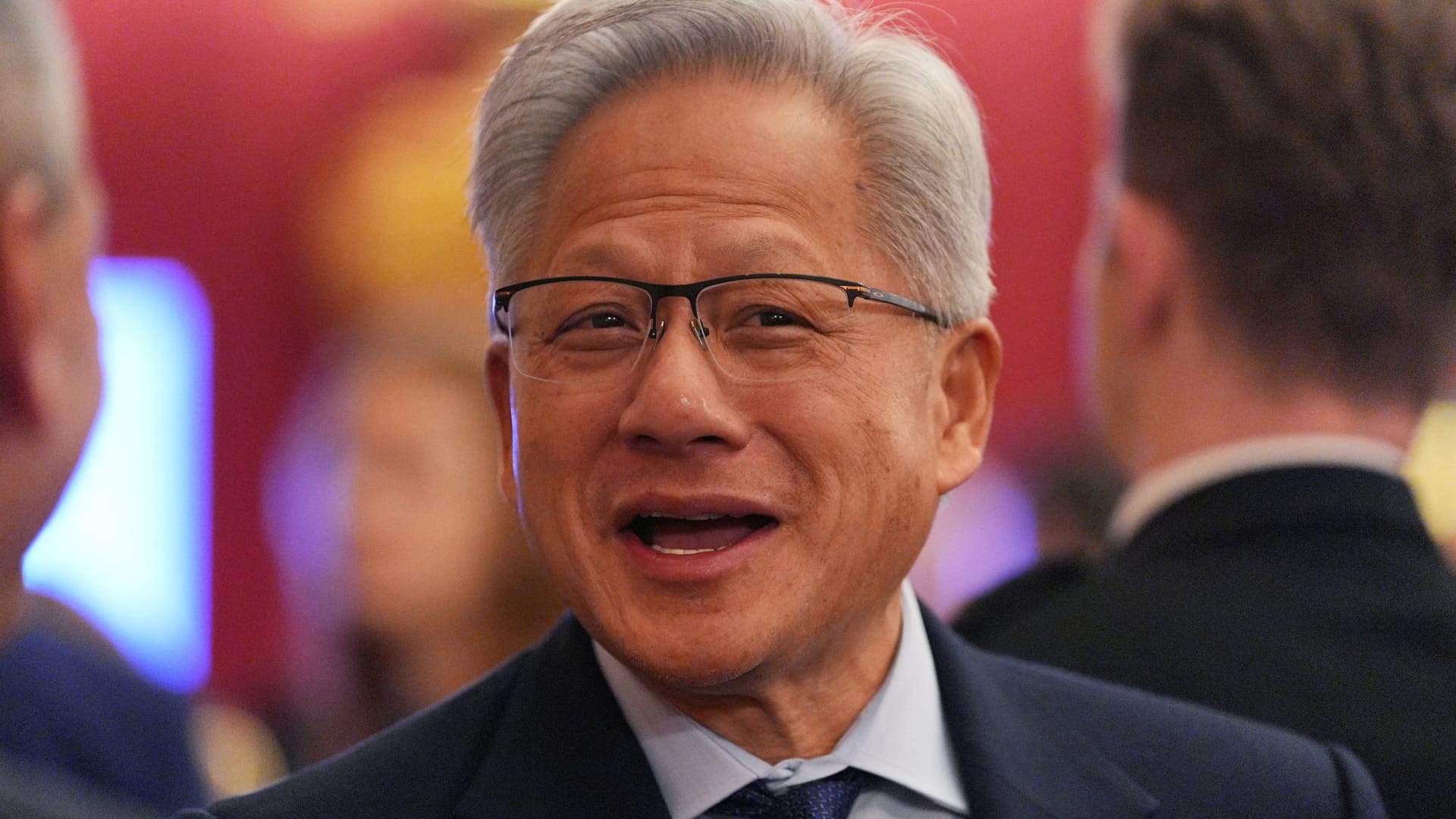

In a move characteristic of his visionary leadership, Nvidia CEO Jensen Huang, back in October, unveiled a staggering revelation. His company, the very engine powering the current AI boom, had already amassed orders totaling an eye-watering $500 billion. These aren’t speculative projections; these are concrete commitments for its cutting-edge chips, slated for delivery across 2025 and 2026. This isn’t just big; it’s monumental, a testament to the insatiable demand for the specialized hardware driving everything from generative AI models to autonomous systems. The sheer scale of this future revenue stream underscores the unprecedented acceleration of AI adoption across every sector.

“Our roadmap is clear, and the demand is unprecedented. The future of AI is being built on our platforms, and the world is accelerating towards it with incredible velocity, far exceeding our initial expectations.” – Jensen Huang (paraphrased)

This forecast, unprecedented in scale for a semiconductor company, immediately sent shockwaves through the financial markets. It painted a vivid picture of an industry not just growing, but exploding, with Nvidia firmly at its epicenter. The company, once primarily known for gaming GPUs, has masterfully pivoted, positioning itself as the indispensable infrastructure provider for the greatest technological shift of our era. This strategic shift, initiated years ago, is now paying dividends that are transforming the global tech ecosystem.

Nvidia’s Indispensable Role in the AI Ecosystem

- Chip Dominance: Nvidia’s H100 and A100 GPUs are the gold standard for AI training and inference, offering unparalleled parallel processing capabilities. Their architecture is specifically designed to handle the complex computations required by large language models and other advanced AI applications.

- Software Stack: Beyond hardware, Nvidia’s CUDA platform provides the crucial software ecosystem that developers rely on, creating a powerful moat around its offerings. This robust software layer makes it incredibly difficult for competitors to replicate Nvidia’s end-to-end solution.

- Full-Stack Innovation: From datacenter solutions like DGX systems to specialized AI factories and robotics platforms, Nvidia is building comprehensive, integrated solutions, not just standalone components. This holistic approach ensures optimal performance and efficiency for AI workloads.

- Ecosystem Partnerships: Nvidia has cultivated deep relationships with major cloud providers, enterprise customers, and AI research institutions, solidifying its position as a preferred partner in the AI race.

The implications of such a backlog are profound. It suggests a sustained, multi-year revenue stream that few companies in any sector can boast, providing a significant degree of financial visibility. But it also raises crucial questions for investors and analysts alike: Is the market fully appreciating the true magnitude of this future income? Or, conversely, is the current valuation already baking in too much optimism, leaving the stock vulnerable to any minor deviation from this ambitious trajectory? The answer will likely dictate market sentiment for months to come.

Earnings: The Moment of Truth for the AI Rally

As the upcoming earnings report looms, all eyes will be on how this half-trillion-dollar promise begins to materialize in current guidance and forward-looking statements. While the $500 billion is for future years, any commentary from Huang or the CFO that either reinforces or subtly adjusts this outlook will be dissected with surgical precision by a market eager for validation. The slightest nuance in executive communication could send shares soaring or plummeting.

Analysts are particularly keen on several key metrics and qualitative insights:

- Quarterly revenue and earnings per share (EPS) against consensus estimates, which are already elevated due to previous beats.

- Guidance for the next quarter and the full fiscal year, a critical indicator of immediate demand trajectory and operational efficiency.

- Updates on supply chain capacity and wafer allocations, crucial for Nvidia’s ability to meet the burgeoning future orders without bottlenecks.

- Any further details on the geographical distribution of demand and the specific industries driving it, providing insight into market diversification and potential risks.

- Commentary on competitive dynamics, including the rise of custom AI chips from tech giants and efforts by rivals like AMD to capture market share.

The market has grown accustomed to Nvidia’s spectacular beats, but the bar continues to rise with each passing quarter. A strong performance, coupled with optimistic future guidance, could ignite another significant leg of the broader AI rally, validating the aggressive valuations assigned to many AI-adjacent companies. Conversely, even a slight miss, or cautious guidance regarding future growth, could trigger a sharp correction, given the meteoric rise of NVDA shares and the general market’s sensitivity to tech sentiment.

The Shadow of Volatility: Will Shares Plunge or Soar After Results?

The context states, “Nvidia Shares May Plunge After Results.” This sentiment highlights the inherent risk associated with a stock that has seen such explosive growth and is priced for near-perfection. The current valuation, reflecting immense future potential, leaves little room for error. Any hint of a slowdown in order growth, an emergent competitive threat, or unexpected macroeconomic headwinds could be amplified by the market’s high expectations, leading to a significant pullback.

The market’s insatiable appetite for AI growth has propelled Nvidia to stratospheric valuations, yet this very success creates a tightrope walk where every financial disclosure carries immense weight.

Yet, the counter-argument is equally compelling. If Nvidia not only meets but decisively surpasses expectations, and crucially, reiterates or even expands upon its long-term vision, the stock could defy gravity once more. The AI revolution is still very much in its early innings, and Nvidia holds a near-monopoly on the foundational compute infrastructure required to power it. This isn’t just about selling chips; it’s about selling the picks and shovels in a digital gold rush, and the demand for gold, in the form of AI processing power, shows no signs of waning. The company’s continuous innovation, from new chip architectures to expanding software libraries, ensures it remains at the forefront.

Beyond the Numbers: A Barometer for the Entire AI Landscape

Nvidia’s earnings are not just a report on one company; they are a critical barometer for the entire artificial intelligence industry and, indeed, the broader technological trajectory. Its performance influences investor confidence across the entire tech sector, impacting startups relying on AI compute, established cloud providers building AI infrastructure, and even sovereign nations investing heavily in domestic AI capabilities. The sheer scale of the half-trillion-dollar forecast suggests a fundamental reordering of global technology priorities, with AI development and deployment at its absolute core.

The Global Race for AI Supremacy

- Enterprise AI Adoption: Companies across every industry are integrating AI at an unprecedented pace, from optimizing complex supply chains to personalizing customer experiences, all requiring robust compute power. This widespread adoption forms a massive and growing addressable market.

- Hyperscaler Investment: Cloud giants like Microsoft, Amazon, Google, and Meta are pouring billions into AI infrastructure, with Nvidia chips forming the undisputed backbone of these colossal investments. Their continued CAPEX spending is a direct driver of Nvidia’s growth.

- Research & Development: Academic institutions, government labs, and cutting-edge startups continue to push the boundaries of AI, necessitating increasingly powerful and efficient hardware to train ever-larger models.

- Geopolitical AI Race: Nations globally are heavily subsidizing AI development to maintain competitive advantage, enhance national security, and foster economic growth, further fueling demand for advanced processors that only Nvidia can provide at scale.

This unprecedented demand creates a powerful virtuous cycle. As AI models become more complex and sophisticated, they require exponentially more powerful chips. As chips become more powerful and accessible, they enable even more ground-breaking AI, pushing the boundaries of what’s possible and generating further demand for next-generation hardware. Nvidia stands squarely at the center of this accelerating feedback loop, continually innovating to meet and exceed future needs. Its deep investments in research and development ensure a pipeline of advanced products.

A Defining Moment for the AI Era

The upcoming earnings call isn’t merely a routine financial disclosure; it is a critical checkpoint for the AI era itself. Nvidia’s ability to capitalize on its unparalleled market position, manage its global supply chain effectively, and continue innovating at a breakneck pace will dictate not only its own trajectory but also the velocity and direction of the global AI transformation. The stakes could not be higher, for both the company and the future of technology.

The future of artificial intelligence is being built on a foundation of silicon, and Nvidia holds the master blueprint, setting the stage for a technological revolution whose ultimate scale and impact are still beyond our wildest imaginings, a testament to the power of human ingenuity amplified by unparalleled processing power.