Nvidia: The $320 Billion Question at the Heart of the AI Revolution

NEW YORK – As the world holds its breath, Nvidia (NVDA) stands at the precipice of a defining moment. Its upcoming earnings report, due on Wednesday, isn’t just another quarterly update; it’s a potential market-shaking event that could trigger an unprecedented $320 billion swing in the chipmaker’s market value. This isn’t merely a testament to Nvidia’s size, but a stark illustration of the immense power and volatility now tethered to the artificial intelligence boom.

The Stakes Have Never Been Higher

Penned by Reuters journalists Laura Matthews and Saqib Iqbal Ahmed, the narrative surrounding Nvidia’s earnings is one of colossal expectation and significant risk. The semiconductor giant, an undisputed kingpin in the AI hardware realm, finds itself under an intense microscope. Investors, analysts, and tech enthusiasts alike are grappling with a fundamental question:

Is the current valuation of Nvidia and, by extension, the broader AI sector, a sustainable breakout driven by genuine innovation and demand, or are we witnessing the inflation of an AI bubble destined to burst?

The answer, or at least a strong indication of it, lies within the figures Nvidia is set to reveal. A $320 billion fluctuation represents the largest post-earnings market capitalization change ever anticipated for a single company, underscoring the extraordinary leverage Nvidia holds in the global tech landscape.

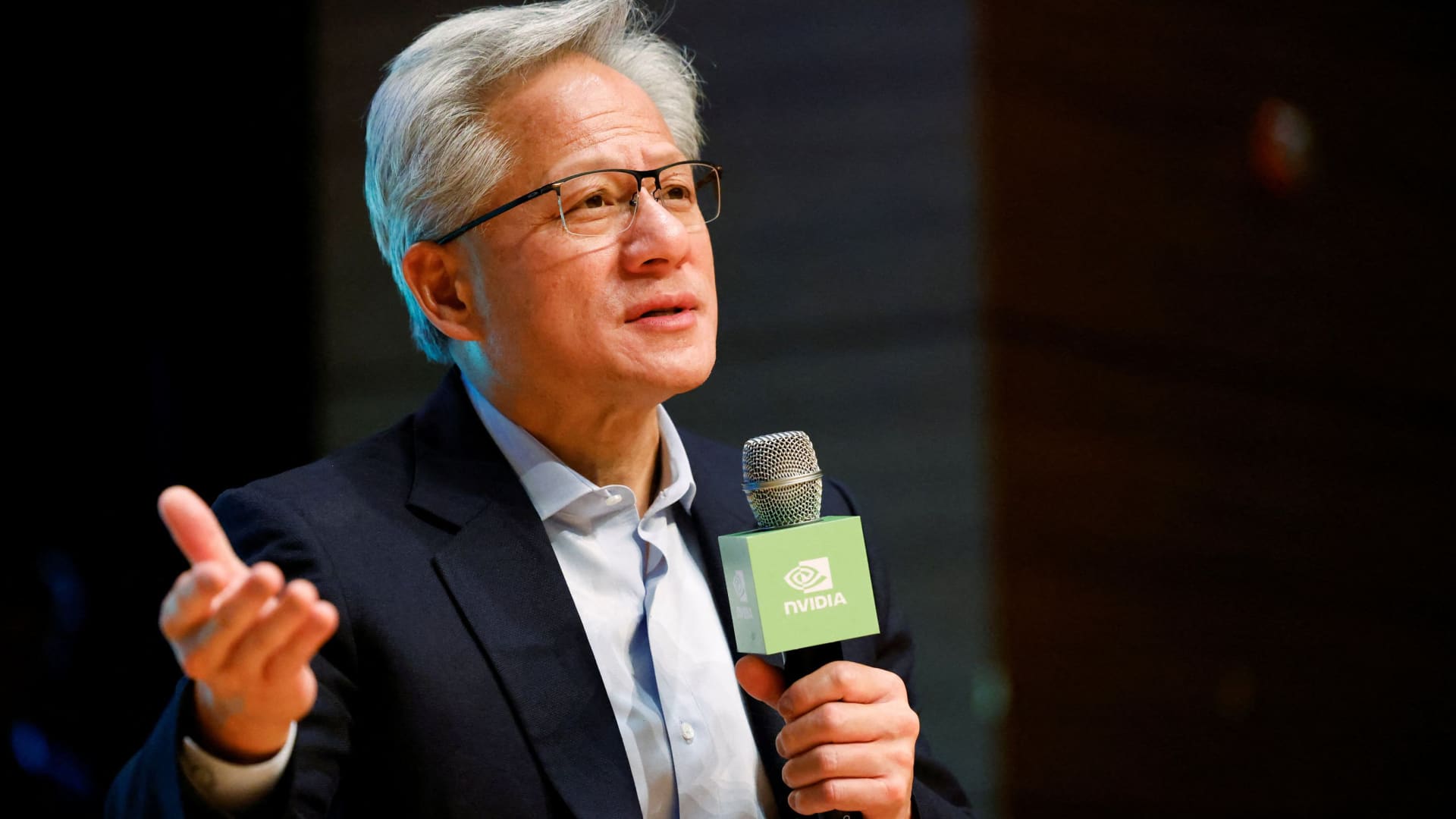

Jensen Huang’s Audacious ‘Half a Trillion’ Forecast

Adding another layer of intrigue to this high-stakes drama is the bold declaration made by Nvidia CEO Jensen Huang. Back in October, Huang surprised investors with a revelation that his company had secured a staggering $500 billion in orders for its cutting-edge AI chips, spanning the combined years of 2025 and 2026. This isn’t just a big number; it’s a forecast that speaks to:

- Unprecedented Demand: The sheer volume of these orders indicates a voracious appetite across industries for the computational power essential for AI development and deployment.

- Market Dominance: It solidifies Nvidia’s seemingly unassailable position as the primary enabler of the AI revolution, with competitors struggling to keep pace.

- Future Revenue Streams: The long-term nature of these orders provides a degree of revenue visibility that is rare and highly sought after in the often-unpredictable tech sector.

This ‘half a trillion’ forecast has become a critical touchstone, a benchmark against which all future performance will be measured. It’s the kind of audacious prediction that can either ignite unprecedented growth or expose deep vulnerabilities if the market’s enthusiasm outstrips tangible delivery.

The AI Boom: More Than Just Hype?

The chips produced by Nvidia are not merely components; they are the very heart of the artificial intelligence boom, powering everything from advanced language models to complex scientific simulations. Their GPUs (Graphics Processing Units), originally designed for gaming, have found an unexpected and exponentially more valuable purpose in accelerating AI workloads.

The question of whether this is a bubble or a breakout is complex. Proponents of the ‘breakout’ theory point to the transformative potential of AI across every sector, from healthcare to automotive, and the indispensable role Nvidia plays. They argue that the demand is real, structural, and only just beginning to manifest.

Navigating Uncharted Waters

Conversely, those who foresee a ‘bubble’ express concerns about valuations that appear disconnected from traditional metrics, the rapid influx of speculative capital, and the potential for a saturation point or increased competition. The historical parallels to dot-com era exuberance are often cited as a cautionary tale.

Ultimately, Nvidia’s earnings report will not just tell a story about one company’s financial performance. It will offer a profound glimpse into the trajectory of the entire AI industry, a bellwether for the technological and economic shifts that are currently reshaping our world.