Nvidia’s AI Reign Confirmed: A New Era of Market Dominance

In the fiercely competitive arena of high technology, few companies command the awe and speculation currently surrounding Nvidia. As the global economy grapples with inflationary pressures and geopolitical uncertainties, Nvidia stands as a colossus, not merely riding the artificial intelligence wave but actively creating its most powerful currents. The imminent Q3 earnings report, slated for Wednesday, November 19, arrives amidst a backdrop of astonishing revelations and equally significant investor apprehension. This is not just another quarterly update; it’s a referendum on the future trajectory of AI and Nvidia’s irreplaceable role within it.

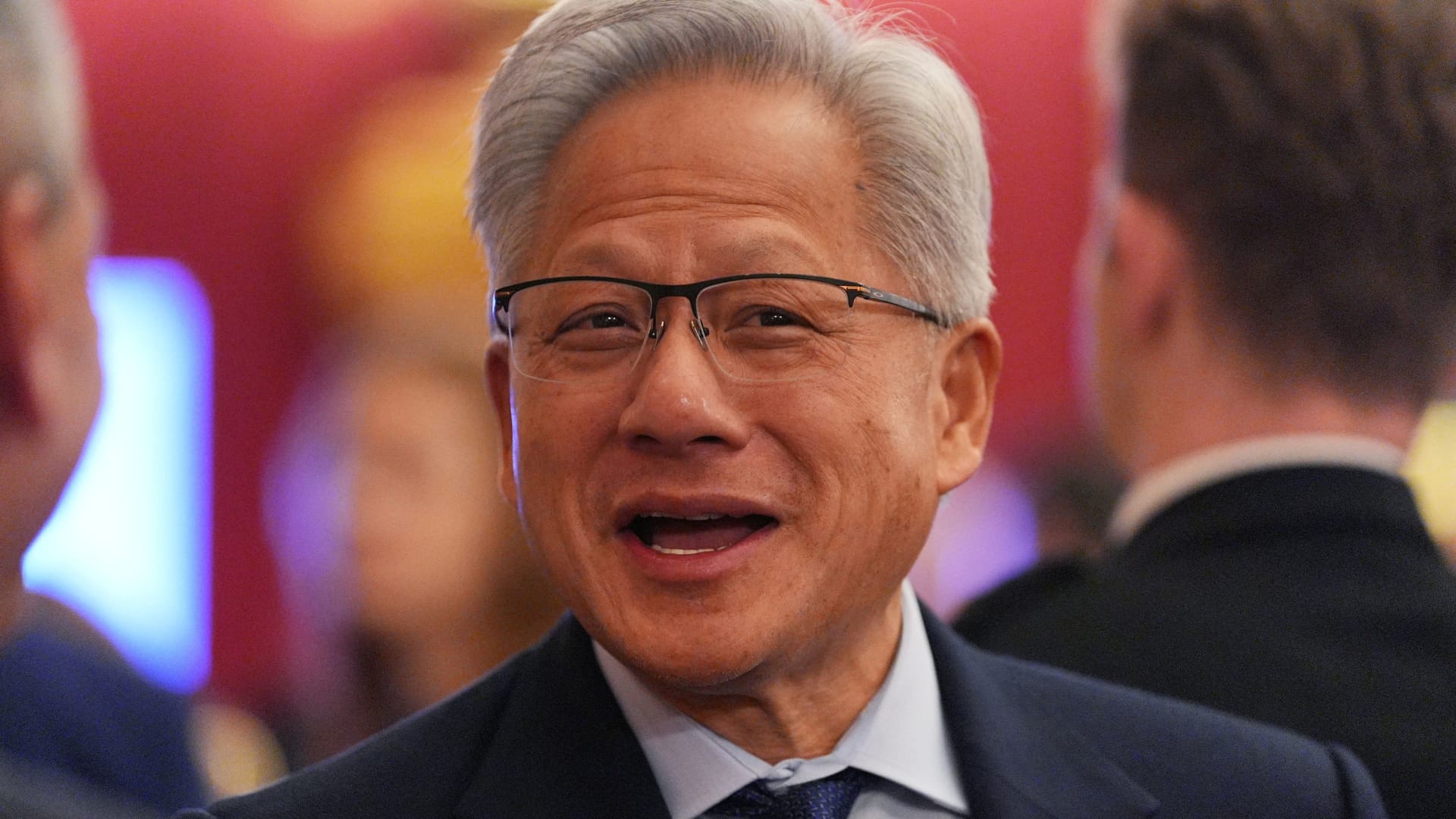

The company, helmed by its visionary CEO Jensen Huang, has become synonymous with the AI revolution. Its Graphics Processing Units (GPUs) are the bedrock upon which the most advanced AI models are trained and deployed, powering everything from conversational agents to autonomous vehicles. The financial markets have responded with a fervor that has seen Nvidia’s market capitalization briefly eclipse a staggering $5 trillion, a testament to its perceived indispensability in the digital age. Yet, beneath the glittering surface of record valuations and unprecedented demand, a nuanced debate rages: is Nvidia’s growth sustainable, or are we witnessing the nascent stages of an AI overbuilding cycle?

The Half-Trillion Dollar Order Book: A Staggering Forecast

The financial world collectively gasped in October when Jensen Huang casually dropped a bombshell: Nvidia has secured a mind-boggling $500 billion in chip orders for 2025 and 2026. This isn’t a projection or a speculative estimate; these are firm commitments from an industry desperate for Nvidia’s cutting-edge silicon. This half-trillion-dollar order book represents not just immense future revenue, but a powerful vote of confidence from the largest cloud providers, enterprises, and research institutions globally, all of whom are investing heavily in AI infrastructure. Such forward-looking visibility is virtually unprecedented in the traditionally cyclical semiconductor industry, fundamentally reshaping how analysts perceive Nvidia’s long-term prospects.

The bulk of these orders is understood to be for Nvidia’s latest generation of AI accelerators, such as the H100 and its successors, designed specifically to handle the immense computational demands of large language models and other complex AI workloads. These chips are not merely components; they are critical strategic assets, enabling the development of next-generation technologies that promise to transform every sector of the global economy. The sheer scale of these orders suggests that the demand for AI compute power is far from peaking; rather, it’s accelerating at an astonishing rate, driving an infrastructure build-out that dwarfs previous technological revolutions.

"A half-trillion dollars in future orders is not just a number; it’s a seismic shift in market dynamics. It tells us that the AI arms race is intensifying, and Nvidia holds the keys to the kingdom. Any concerns about a slowdown in demand must now be re-evaluated in the face of such overwhelming evidence of sustained, long-term growth." – Leading Semiconductor Analyst.

Unlike conventional quarterly revenue forecasts, which offer a snapshot of immediate performance, this revelation paints a vivid picture of Nvidia’s strategic positioning years into the future. It provides a rare glimpse into the long-term investment cycles of the world’s most innovative companies, all of whom are banking on Nvidia to deliver the raw processing power required to realize their AI ambitions. This announcement effectively de-risks a significant portion of Nvidia’s future revenue streams, offering a level of certainty that few other public companies can boast.

Q3 Earnings Amidst Unprecedented Expectations

As November 19 approaches, Wall Street analysts are fine-tuning their models, anticipating another blockbuster earnings report from Nvidia. The consensus expectation is for robust Q3 results, driven by the relentless demand for its data center GPUs. The stakes are incredibly high; given the company’s meteoric rise and its critical role in the AI narrative, even a slight deviation from the elevated expectations could send ripples across the entire tech sector.

Investors will be scrutinizing several key metrics beyond just top-line revenue and earnings per share:

- Data Center Revenue Growth: The primary engine of Nvidia’s recent success, analysts will be looking for continued acceleration in this segment, confirming the sustained AI boom.

- Gross Margin: The profitability of Nvidia’s highly specialized chips is crucial. Maintaining or improving high gross margins indicates pricing power and efficient production.

- Guidance for Q4: Forward-looking statements will be paramount, offering clues about the pace of AI infrastructure investment heading into the next fiscal year.

- Supply Chain Commentary: Any insights into production capacity, lead times, and efforts to meet the overwhelming demand will be closely watched.

The market has become accustomed to Nvidia exceeding expectations, making each subsequent report a higher hurdle. The company’s ability to consistently outperform has fueled its valuation, but also introduced a unique pressure: the expectation of perfection. Anything less than stellar performance, particularly in its flagship data center segment, could prompt a re-evaluation of its growth premium.

Fuelling the Artificial Intelligence Revolution

Nvidia’s foundational role in AI extends far beyond merely supplying chips. The company has cultivated an entire ecosystem around its CUDA platform, a parallel computing architecture that allows developers to leverage Nvidia’s GPUs for general-purpose computing. This software layer has created a powerful moat, making it incredibly difficult for competitors to displace Nvidia, even with technically comparable hardware.

The applications of Nvidia’s technology are remarkably diverse, touching nearly every facet of modern innovation:

From hyperscale cloud providers like AWS, Microsoft Azure, and Google Cloud, which use Nvidia GPUs to power their vast AI services, to automotive companies developing self-driving car capabilities, Nvidia’s technology is omnipresent. Healthcare researchers utilize its platforms for drug discovery and medical imaging analysis, while scientific communities rely on its supercomputing capabilities to model complex phenomena, from climate change to astrophysics. This pervasive influence underscores Nvidia’s strategic importance, positioning it as a foundational technology provider for the 21st century.

The Paradox of Prosperity: Bulls, Bears, and Overbuilding Concerns

Despite the overwhelming positive sentiment driven by its half-trillion-dollar order book and dominant market position, Nvidia is not without its skeptics. The rapid escalation of AI infrastructure spending has given rise to a critical debate about potential "AI overbuilding," a term that conjures echoes of past tech bubbles and subsequent market corrections.

The Bull Case: Unstoppable Demand and Innovation

Proponents of Nvidia’s continued ascent point to several compelling factors. The AI revolution is still in its early innings, with enterprise adoption only just beginning to accelerate. The demand for increasingly sophisticated AI models, requiring exponentially more compute power, shows no signs of abating. New product cycles, such as Nvidia’s Blackwell architecture rumored for next-generation chips, promise further performance gains that will drive continued upgrades.

- The vast untapped market of enterprises globally seeking to integrate AI into their operations.

- Continuous breakthroughs in AI research demanding more powerful and efficient processors.

- Expansion into new segments like robotics, industrial automation, and edge AI, broadening the addressable market.

- Growing software and platform revenue, creating recurring income streams and strengthening the ecosystem.

The Bear Case: AI Overbuilding and Market Saturation

Conversely, the bear camp raises valid concerns about the sustainability of the current growth trajectory. The concept of "AI overbuilding" suggests that the current pace of infrastructure investment might outstrip the immediate practical applications and revenue generation from AI services. This could lead to a slowdown in future orders as cloud providers and large enterprises digest their existing investments.

"We’ve seen this before in tech cycles: massive investment leads to excess capacity, which then stifles future spending. While AI is transformative, the current build-out pace needs careful monitoring. The half-trillion forecast is incredible, but markets can quickly shift if utilization rates don’t meet expectations." – Veteran Market Strategist.

Historical parallels, such as the dot-com bubble or the overinvestment in fiber optic networks in the late 1990s, serve as cautionary tales. While AI’s fundamental utility is undeniable, the speed and scale of current investments raise questions about potential demand volatility. Furthermore, competition is intensifying. Hyperscalers are developing their custom AI silicon (ASICs) to reduce reliance on external vendors, and other chipmakers are aggressively pursuing their own AI strategies, threatening to erode Nvidia’s market share in specific niches.

The argument is not against AI’s long-term potential, but rather against the potential for short-to-medium-term imbalances between supply and demand for specialized AI hardware. If the return on investment for massive AI infrastructure projects takes longer than anticipated, or if the pace of new AI applications slows, future orders could be impacted.

Beyond the Numbers: Nvidia’s Strategic Horizon

Nvidia’s ambition extends beyond being merely a hardware provider. The company envisions itself as a full-stack computing platform company, integrating hardware, software, and services to offer end-to-end solutions. This strategic shift is crucial for maintaining its competitive edge and driving long-term value.

Diversification and New Growth Vectors

The company is actively diversifying its portfolio into new high-growth areas. Its Omniverse platform aims to create a metaverse for industrial applications, facilitating collaborative design and simulation. Investments in robotics, edge AI, and autonomous systems are expanding its reach into emerging markets that will demand powerful, specialized computing at the network’s periphery.

Strategic partnerships with major players across various industries, from manufacturing to healthcare, are strengthening Nvidia’s ecosystem and ensuring its technology remains embedded in the core infrastructure of the future. Acquisitions, when strategically aligned, further enhance its technological capabilities and market penetration.

- Advancements in quantum computing and quantum-classical hybrid systems, where Nvidia’s expertise in parallel processing could be crucial.

- The accelerating demand for explainable AI and trusted AI, requiring new software tools and hardware architectures.

- The growth of personalized AI models, pushing compute power closer to the end-user (edge AI).

The $5 Trillion Benchmark: A Glimpse into the Future

The brief moment when Nvidia’s market capitalization touched $5 trillion was more than just a financial milestone; it was a psychological marker. It signified the market’s profound belief in the transformative power of AI and Nvidia’s pole position in shaping that future. Such valuations place immense pressure on execution, demanding consistent innovation and flawless strategic decisions. It also reflects a broader market sentiment that allocates unprecedented capital to companies at the forefront of technological paradigm shifts.

This valuation, even if fleeting, underscores the market’s assessment of Nvidia’s long-term earning potential, projecting a future where AI is not just pervasive but foundational to economic activity. It’s a testament to the belief that Nvidia isn’t just selling chips; it’s selling the future, one powerful GPU at a time.

Nvidia stands at an extraordinary juncture, embodying the exhilarating promise and inherent risks of the AI era. Its half-trillion-dollar order book offers a compelling narrative of future dominance, yet the specter of AI overbuilding looms as a potent counter-argument. The upcoming Q3 earnings will provide critical data points, but the overarching story is one of a company navigating the treacherous yet immensely rewarding waters of a technological revolution, its destiny intertwined with the very future of artificial intelligence itself.