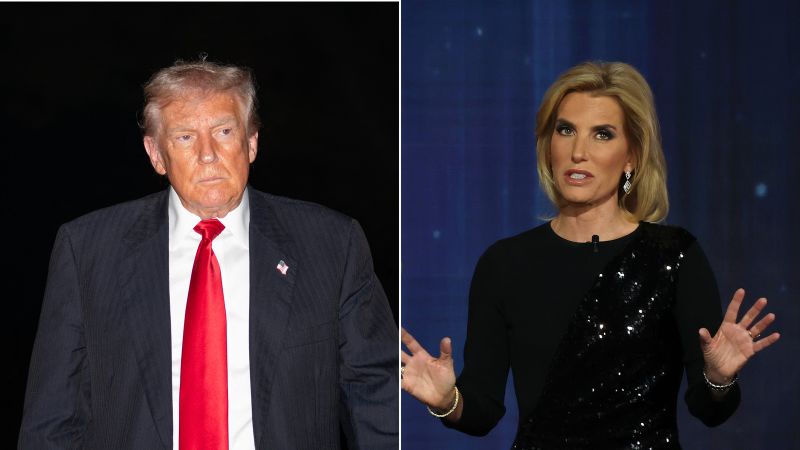

Hold onto your MAGA hats, folks, because something truly unprecedented just happened in the hallowed halls of Trump-friendly media. Laura Ingraham, a beacon of loyalty on Fox News, dared to do the unthinkable: she challenged Donald Trump. Yes, you read that right. In a world where Fox News interviewers typically treat the former president with the deference usually reserved for a deity, Ingraham pulled a move that sent shockwaves through the pro-Trump ranks and had everyone from establishment pundits to basement-dwelling bloggers asking, “What in God’s name is going on?”

The Great Ingraham Heresy: A Fox News Coup?

For years, the unwritten rule of interviewing Donald Trump on Fox has been simple: lob softballs, nod sagely, and avoid anything that might ruffle the golden coif. It’s a formula designed not to inform, but to reinforce, to affirm, and to keep the MAGA base simmering in a stew of unwavering devotion. We’ve seen it time and again – the sycophantic praise, the unchallenged pronouncements, the utter lack of journalistic curiosity that would make a high school newspaper editor blush. But then came Laura Ingraham, and suddenly, the script flipped faster than a politician changing their stance on a hot-button issue. What possessed her? Was it a calculated risk, a desperate play for journalistic credibility, or a sign that even the most loyal lieutenants are starting to feel the pressure?

- The Unspoken Code: For too long, the Trump-Fox relationship has been less an interview and more an affirmation session, stifling genuine inquiry.

- The MAGA Muzzle: Any deviation from the pro-Trump narrative risks immediate and brutal backlash from the most fervent supporters.

- A Cracks in the Facade? Ingraham’s challenge suggests internal tensions might be more profound than previously imagined within the conservative media ecosystem.

The Unthinkable: A Challenge From Within

Imagine, if you will, the sheer audacity. While the specifics of Ingraham’s challenge remain a topic of fervent debate and whispered speculation, the very act of questioning Trump in a way that deviated from the pre-approved script is nothing short of revolutionary. It’s like seeing a loyal guard dog suddenly nip at its master’s heels. What was the trigger? Was it a single, incisive question, a pointed follow-up, or a broader tone of skepticism that broke the mold? Whatever it was, it was enough to spark a “MAGA backlash” that reverberated across social media and, undoubtedly, through the back channels of Mar-a-Lago. The mere hint of dissent sends shivers down the spines of those who believe unwavering loyalty is the only currency that matters in Trump-world. This wasn’t just a tough question; it was a perceived betrayal, a chink in the armor of absolute allegiance.

Mortgage Madness: 50 Years of Debt? Are You Kidding Me?

And as if the political drama wasn’t enough to keep us all glued to our screens, another bombshell dropped, threatening to upend the very foundation of the American dream: a proposal for a 50-year mortgage. Let that sink in. Fifty. Years. We’re talking about a financial commitment that would outlive most pets, several careers, and perhaps even a significant portion of our own lives! This wasn’t some fringe idea cooked up by a TikTok influencer; this was a serious proposal floated by a top housing official in the Trump administration. The sheer audacity, the unbridled recklessness of such a concept, immediately sparked outrage and disbelief. White House officials, according to sources, were reportedly “unhappy” about the idea. “Unhappy” doesn’t even begin to cover it. We’re talking about a proposal that sounds less like sound economic policy and more like a cruel joke on the aspirations of hardworking Americans.

- Generational Debt Trap: A 50-year mortgage could lock families into debt for decades, limiting financial flexibility and wealth building.

- Phantom Affordability: While monthly payments might appear lower, the total cost of interest over 50 years would be astronomical, making homes even less affordable in the long run.

- Market Instability: Introducing such a long-term product could have unforeseen and potentially disastrous effects on the housing market, creating new bubbles and risks.

Who’s Engineering This Housing Horror Show?

The immediate question on everyone’s lips: who in their right mind thought this was a good idea? And more importantly, why was it released without being “fully vetted” by top administration officials? This isn’t a minor policy tweak; this is a fundamental reshaping of how Americans purchase homes. The fact that it blindsided key players in the White House speaks volumes about the internal disarray and lack of coordination that often plagued that administration. Was it an rogue official, a trial balloon floated without permission, or a desperate attempt to ‘solve’ the housing crisis with a gimmick that would only deepen the problem? The answers, as always in the murky waters of political backroom dealings, remain elusive, shrouded in a veil of convenient denials and strategic silence. But one thing is clear: the American public deserves to know who hatched this plan and why it was even considered.

MAGA Backlash Meets White House Woes: A Perfect Storm

The confluence of these two events – Ingraham’s challenge and the 50-year mortgage fiasco – paints a vivid picture of an administration (or a former administration still casting a long shadow) perpetually operating on the precipice of chaos. The “MAGA backlash” against Ingraham isn’t just about loyalty; it’s about control. It’s about maintaining a narrative, a unified front, at all costs. Any crack in that facade is seen as a weakness, an invitation for the enemy to attack. And then you have the mortgage proposal, a policy idea so fundamentally flawed and so poorly managed that even the administration’s own officials were scrambling to distance themselves from it. This isn’t just a policy blunder; it’s a testament to a system that, at times, seemed to prioritize impulsive ideas over diligent analysis, and PR stunts over genuine solutions.

Unvetted Proposals: A Pattern of Chaos?

Let’s be brutally honest: the concept of unvetted proposals being released to the public isn’t new in the political arena. However, the sheer magnitude of a 50-year mortgage plan—a financial instrument that would bind generations to colossal debt—being floated without comprehensive internal review is staggering. It raises serious questions about the decision-making processes, or lack thereof, within that specific apparatus. Was it hubris? A genuine misunderstanding of economic realities? Or was it something far more cynical: a deliberate attempt to distract, to test the waters, to see just how much the public would tolerate? The implications are chilling, suggesting that critical financial policies, impacting millions, could be launched on a whim, without the rigorous examination that responsible governance demands. This kind of haphazard approach doesn’t just erode public trust; it actively jeopardizes the financial stability of ordinary families.

The Real Cost: Beyond the Monthly Payment

While proponents (if any dare to step forward now) might argue that a 50-year mortgage makes homeownership “more affordable” by lowering monthly payments, this is a dangerous illusion. It’s akin to putting a band-aid on a gaping wound. The real cost isn’t just the sticker price; it’s the astronomical amount of interest paid over half a century. We’re talking about potentially paying double, triple, or even quadruple the home’s original value just in interest alone. It’s a generational wealth transfer from hardworking families straight into the coffers of financial institutions. Instead of building equity and securing a legacy, families would be tethered to a perpetual debt machine. This isn’t a solution; it’s a financial death sentence for the American dream, designed to keep people indebted and dependent. It’s a policy proposal that stinks of desperation, a cynical attempt to manipulate the perception of affordability while simultaneously deepening the financial shackles of the populace.

Is This Genius or Just Plain Delusion?

One has to wonder: is there a twisted genius at play here, or is it merely pure, unadulterated delusion? Could the architect of the 50-year mortgage truly believe this would be a net positive for the average American family? Or is it a more insidious strategy, designed to prop up an inflated housing market on the backs of future generations, ensuring that financial institutions continue to rake in profits while ordinary citizens struggle under the weight of lifelong debt? The “spicy” truth is that without transparency, without accountability, and without a clear explanation for how such an unvetted, potentially disastrous idea came to see the light of day, we are left to speculate the worst. The lack of genuine debate and the apparent internal opposition only amplify the suspicion that this wasn’t a well-intentioned, albeit flawed, policy, but something far more concerning.

The Media’s Role: A Glimmer of Scrutiny?

And what of the media’s role in all this? While Laura Ingraham’s “challenge” was a momentary deviation from the norm, it highlights a broader truth: genuine scrutiny, even from within ostensibly friendly circles, is vital. When journalists, regardless of their political leanings, fail to ask difficult questions, the public suffers. Unvetted proposals, flawed policies, and charismatic leaders go unchallenged, often leading to detrimental outcomes for millions. Ingraham’s brief moment of rebellion, whether intentional or not, served as a stark reminder that even a broken clock is right twice a day, and even a network often criticized for its deference can, on rare occasions, stumble upon a moment of genuine journalism. It begs the question: how many other poorly conceived ideas languish in the shadows, unexposed because the media gatekeepers are too busy applauding rather than interrogating?

What This Means for YOU, the Beleaguered Citizen

Ultimately, these intertwined narratives – the political theatrics and the potentially ruinous financial proposals – coalesce into a grim reality for the average citizen. You are caught in the crosshairs of a political landscape where loyalty often trumps logic, and where revolutionary (and often reckless) ideas are floated with minimal oversight. The Ingraham incident, however brief, might offer a sliver of hope that accountability isn’t entirely dead. But the 50-year mortgage proposal? That’s a stark warning. It’s a siren call, reminding us that constant vigilance is required when those in power, or those still wielding influence, propose ideas that could fundamentally alter your financial future. Do not be swayed by the promise of lower monthly payments when the hidden cost is a lifetime of debt. Demand answers, demand transparency, and demand that those who govern do so with a modicum of common sense and a genuine concern for the long-term well-being of the populace.

This isn’t just about politics; it’s about your wallet, your family’s future, and the very definition of what it means to achieve financial independence in America. The stakes couldn’t be higher. Are you paying attention? Because they certainly aren’t making it easy for you to ignore the chaos they’re creating. The curtain has been pulled back, even if for a fleeting moment, revealing the machinations behind the scenes. What you do with this knowledge, how you demand better, is now entirely up to you. Don’t let them saddle you with a half-century of debt while they play political games. The time for polite observation is over. It’s time to demand action, accountability, and sanity from our leaders, past, present, and future. The housing market, and indeed your very financial solvency, hangs in the balance, teetering on the brink of this unholy alliance of political maneuvering and economic folly. This isn’t just news; it’s a battle for your economic soul, and you’re squarely in the crossfire. Will you stand by, or will you fight against the tide of financial subjugation? The choice, dear reader, is yours. The storm is brewing, and the forecast is looking increasingly volatile. Get ready, because the ride is far from over, and the consequences of these political and financial gambits will be felt for generations to come. This isn’t just a ripple; it’s a tsunami of debt waiting to engulf everything in its path.

Laura Ingraham actually *challenged* Trump? The MAGA faithful are in an uproar! And who cooked up this insane 50-year mortgage idea that even *his own White House* hates? Is it incompetence or a brilliant, diabolical scheme? You decide. #Trump #Ingraham #MortgageScandal #MAGA