Brian Moynihan is Selling You a Lemon: The AI Productivity Myth

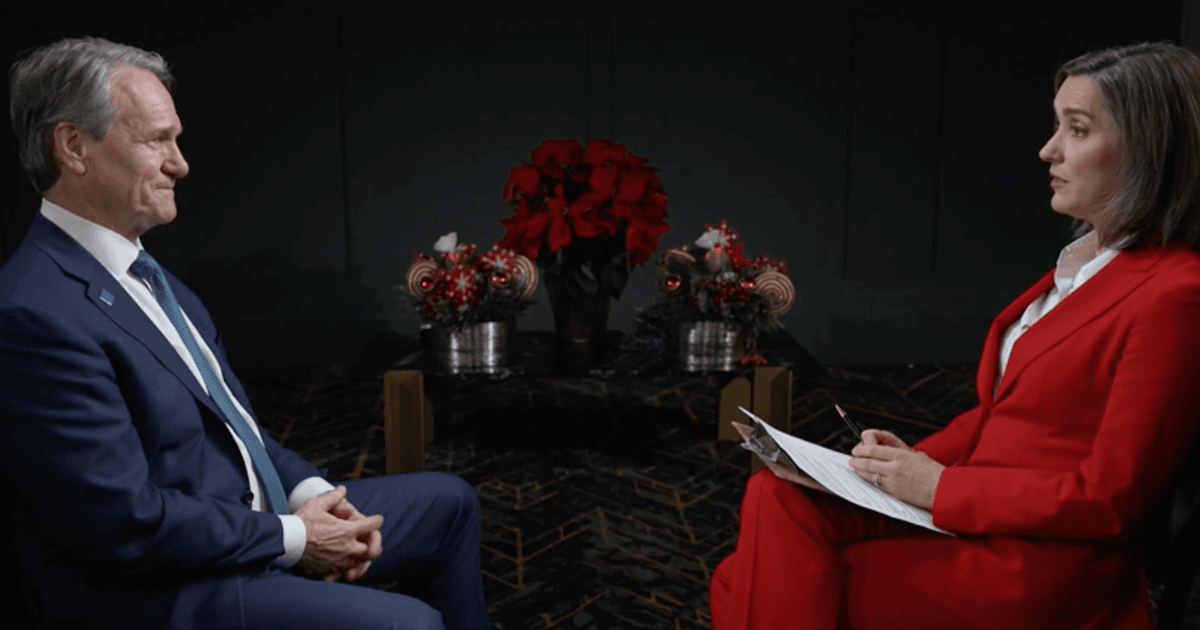

Let’s cut the corporate spin cycle right now. Brian Moynihan, the Chairman and CEO of Bank of America, is talking up AI’s economic benefit, claiming it’s “kicking in more” and driving the U.S. economy. Does he genuinely believe this, or is he just carrying water for the Silicon Valley plutocrats whose investments his institution underwrites? It’s a rhetorical question, frankly, because we all know the answer is sitting right there, gleaming on the balance sheet: AI benefits the people holding the stock, and nobody else; it is the most nakedly self-serving pronouncement a financial titan could possibly make while simultaneously planning to gut thousands of middle-management jobs across his vast, bureaucratic empire, substituting expensive human intuition for cheap, scalable, morally blank algorithms designed solely to optimize the quarterly earnings report.

It’s all fluff.

When a CEO—especially a bank CEO—starts waxing poetic about productivity gains driven by opaque technology, you don’t need to look at GDP figures; you need to look at layoff notices, which they are expertly disguising as “efficiency adjustments” or “strategic resource reallocation.” Bank of America’s primary motivation, like all massive financial institutions, is maximizing shareholder value, and AI is the most potent weapon invented since the invention of the spreadsheet for achieving that goal by extracting labor costs without reducing revenue streams, creating the illusion of organic growth where none actually exists.

The Jobs Slaughterhouse: Who is Actually Paying for AI?

The core problem with Moynihan’s rosy picture—and every other CEO who parrots this nonsense—is the fundamental misunderstanding of what ‘economic benefit’ truly means in a capitalist society obsessed with immediate scale; they treat human capital as a liability to be minimized, while treating massive, undifferentiated pools of data as an asset to be exploited, thereby accelerating the decline of stable, salaried work.

Do you really think Bank of America is investing billions in generative AI so that their entry-level analysts can spend more time meditating? Please. They are doing it to automate underwriting, risk assessment, fraud detection, and, most crucially, customer service and advisory roles that form the backbone of the middle class in financial hubs around the globe, and they will only stop when the last human whose job description involves routine data processing is replaced by a digital ghost.

Look at the historical context: every single time a technology promised to usher in an era of leisure and broad prosperity—from industrial automation in the 1920s to the personal computer revolution in the 1980s—what actually happened was a temporary boom for the owners of the technology, followed by catastrophic displacement for the working class whose wages stagnated or declined while they desperately tried to ‘reskill’ themselves for phantom jobs that never materialized at scale.

Why is this time different?

It isn’t, except for the speed. The speed at which large language models (LLMs) can assimilate and replicate the intellectual labor previously performed by college-educated workers is frighteningly rapid, compressing a century of industrial automation displacement into a five-year window, which is why Moynihan needs to talk about the ‘benefits’ now, before the full social cost of this technological upheaval becomes painfully apparent in the jobless numbers.

The Myth of Broad-Based Productivity

When Moynihan says AI is “driving the U.S. economy,” what he means is that it is driving the financialization of the economy deeper into the abyss, creating localized efficiency gains for massive conglomerates that can afford the upfront capital investment necessary to acquire these powerful digital tools, exacerbating inequality with frightening speed and precision. Where is the evidence of broad productivity growth that benefits the median household, the kind of growth that raises real wages for nurses, teachers, or small business owners, instead of simply allowing Goldman Sachs to execute trades 0.0001 seconds faster than Merrill Lynch?

We are stuck in a macroeconomic scenario where corporate profits are soaring—driven largely by these efficiency gains and price hikes—but actual, tangible GDP growth remains sluggish, failing to lift the general population out of the sticky mud of inflation and rising housing costs, creating a divergence between the stock market reality and the kitchen table reality that is becoming socially unsustainable.

This is the core deception. AI does not create new demand; it simply makes the supply side cheaper for the incumbents. It is a zero-sum game masked as a technological miracle. Are we supposed to celebrate a situation where five employees can now do the work of fifty? Yes, BofA’s profits look great, but the 45 displaced workers aren’t suddenly starting five high-tech AI startups; they are driving for Uber or applying for federal benefits, shifting the cost of human obsolescence from the corporate balance sheet onto the taxpayer, which is the biggest con of the 21st century.

Talk about kicking the can.

The technological evangelists always pivot to the idea of ‘new jobs being created.’ What new jobs, exactly? Prompt engineer? Data sanitation specialist? These roles are inherently unstable, often contract-based, and highly susceptible to being automated themselves once the LLMs learn to optimize the optimization process, creating a snake-eating-its-own-tail scenario of perpetual precarity.

The Opaque Algorithmic Risk

Beyond the labor market catastrophe, let’s talk about financial stability. Moynihan is leading one of the world’s largest financial institutions, and the speed at which complex, black-box AI models are being integrated into core risk assessment and capital allocation decisions should give anyone who lived through 2008 a cold sweat. What happens when every major financial institution is relying on slightly varied versions of the same predictive model, trained on the same skewed historical data?

The moment one model fails, they all fail, creating an ‘algorithmic cascade’ far faster and more catastrophic than the subprime mortgage meltdown, because there are no humans left in the loop capable of overriding the automated selling frenzy when the machines suddenly decide the world is ending; it’s a terrifying singularity of shared systemic risk, yet the CEOs are too busy counting their efficiency dividends to care about the structural integrity of the global financial system.

Remember the flash crashes of the 2010s? They were caused by relatively rudimentary high-frequency trading algorithms. Now imagine those algorithms powered by multimodal AI with the capacity to generate novel risk scenarios based on geopolitical instability and social media sentiment. That’s not ‘economic benefit’; that’s a ticking time bomb built into the very foundation of the capital markets, awaiting the perfect confluence of computational bias and real-world panic to explode.

Are they auditing these models?

Of course not. Transparency is anathema to market advantage, and if BofA were forced to truly disclose the training data and operational logic of their proprietary risk AIs, their competitive edge would vanish, which means we are all betting the house on systems we cannot inspect, managed by people who only understand the inputs and outputs, not the terrifying mechanics of the black box itself.

The Ghost in the Machine and the Central Bank’s Dilemma

The Federal Reserve, bless their hearts, is completely bamboozled by this whole situation, trying to understand how inflation and unemployment can remain stubbornly high while corporate profitability skyrockets due to tech-driven cost suppression, a dichotomy that traditional economic models were simply not built to handle. We are witnessing the decoupling of the labor market from the capital market in real time, where technological advancement no longer guarantees generalized prosperity, but instead guarantees the centralization of power into the hands of a few firms that control the data and the models.

Moynihan, sitting in his perch, claims AI is ‘kicking in.’ I agree it’s kicking in—right into the teeth of the American middle class, delivering efficiency gains to the top one percent while dissolving stable career paths everywhere else. This isn’t innovation; this is extraction rebranded as progress, an old corporate trick wrapped in shiny new silicon.

If AI were truly driving robust, broad economic growth, we would see massive investments in public infrastructure, soaring real wages, and a general sense of optimism regarding generational upward mobility. Instead, we see debt-fueled stock buybacks, stagnant wages for 90% of the population, and a pervasive, existential anxiety about job security, especially among white-collar workers who used to feel insulated from the historical ravages of automation.

The transcript from that interview, dated late 2025, serves as a high-water mark for corporate denial, a moment where the financial elite tried one last time to convince the masses that the machine designed to replace them was actually their friend. Don’t buy it. The AI revolution isn’t a tide lifting all boats; it’s a tsunami designed to lift the super-yachts of the financial establishment while drowning everyone rowing a dinghy. We should treat Moynihan’s claims not as economic commentary, but as mandatory marketing collateral designed to protect the increasingly fragile narrative of perpetual technological progress, a narrative that is buckling under the weight of real-world suffering and financial inequality.

Wake up, people. They are not giving you a raise; they are training the algorithm that will sign your termination papers. That’s the real benefit of AI for the global banking sector, and Moynihan knows it down to the last decimal point on his year-end bonus statement. The bubble is going to burst, and when it does, it won’t be the bankers holding the bag; it will be the redundant masses whose jobs evaporated into the silicon ether.

History repeats itself.

The question is: when the great AI reckoning arrives, will we finally hold these financial cheerleaders accountable for the systemic social collapse their ‘efficiency’ caused?

Photo by Leonhard_Niederwimmer on Pixabay.