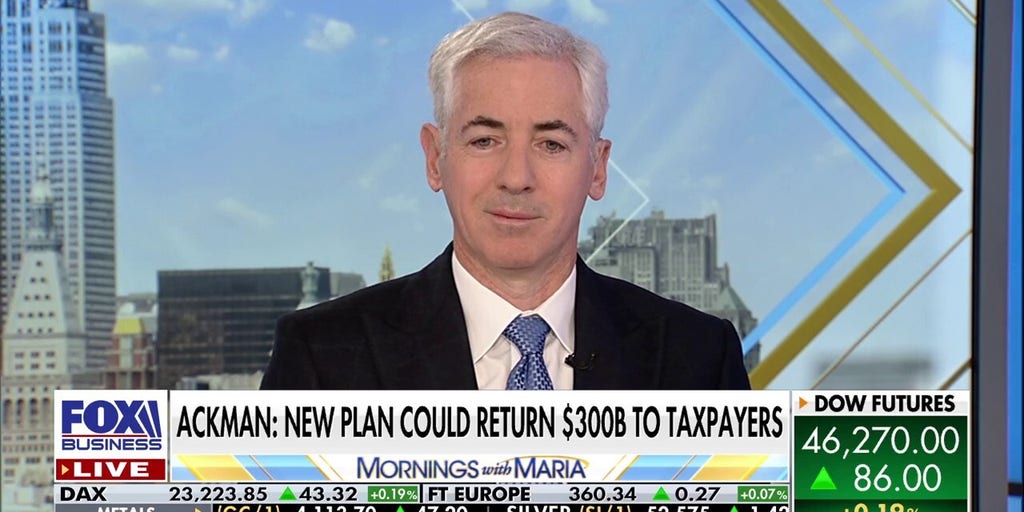

Another day, another multi-billion-dollar promise for Fannie Mae and Freddie Mac. Bill Ackman, the billionaire investor whose career is built on high-stakes market shake-ups, is back, floating a staggering $300 billion rescue plan. But let’s be blunt: is this a genuine lifeline for the beleaguered mortgage giants, or just another calculated power play designed to line the pockets of a select few, leaving taxpayers and long-suffering investors holding the bag?

The Real Story

The epic saga of Fannie and Freddie isn’t just a dry financial footnote; it’s a two-decade-long financial drama, a government-sanctioned cash cow that has siphoned billions from the housing market directly into Treasury coffers. Ackman, CEO of Pershing Square, has long viewed these institutions as a prime target for a speculative play, pouring significant capital into their preferred stock years ago, only to see it entangled in endless legal battles and political gridlock. His proposed $300 billion injection isn’t philanthropy; it’s a brazen, calculated maneuver to finally recapitalize these entities and pry them from government conservatorship, unlocking potentially massive returns for his firm. The date November 18th, once whispered as a beacon of clarity, now looms as a potential cliff edge. Even as Ackman touts salvation, his recent admission that an IPO ‘right now’ is off the table sends shivers down the spines of hopeful investors. This isn’t merely a delay; it’s a stark, infuriating reminder that the ‘destiny’ of these crucial entities remains shrouded in political machinations, keeping billions locked in perpetual limbo. What’s the real agenda when a ‘rescue’ comes with strings so tightly wound they could choke the very institutions they claim to save?

“Ackman isn’t playing chess; he’s playing five-dimensional poker,” whispered one D.C. insider, sipping lukewarm coffee. “Every move is designed to maximize his position, irrespective of the retail investor caught in the crossfire. This ‘rescue’ is simply his best hand yet, a high-stakes bluff against decades of bureaucratic inertia.”

Why It Matters

For over fifteen years, government conservatorship has morphed Fannie and Freddie into something far removed from their original purpose. They became a convenient fiscal piggy bank, allowing the Treasury to sweep virtually all their profits, turning what should be independent, robust guarantors of the American dream into a political football. Ackman’s plan, on paper, promises to end this highly controversial sweep, stabilize the broader housing market, and theoretically, deliver a long-awaited windfall to shareholders who’ve endured decades of uncertainty and financial purgatory. But peel back the layers, and the immense power and profit potential for Pershing Square become glaringly obvious. The real money isn’t just in the $300 billion initial injection; it’s in controlling the narrative, influencing regulatory outcomes, and ultimately dictating the eventual multi-trillion-dollar valuation of entities that underpin the entire American housing finance system. When a single billionaire, with a history of aggressive activism, publicly dictates the ‘destiny’ of such critical, quasi-government institutions, every single American — from the homeowner to the pension-holder — should be asking: what’s in it for them? And what risks are we all taking on with this high-wire act?

The Bottom Line

The clock continues its relentless tick towards November 18th, a date circled in red by every investor, politician, and market watcher desperate for a definitive resolution to the Fannie and Freddie saga. Yet, hope is a dangerous thing in this game. With Ackman himself now backpedaling on an immediate IPO, and the government notoriously reluctant to relinquish control of its most reliable cash machine, the most likely scenario isn’t a triumphant release, but rather, a continuation of purgatory. Expect more grand plans, more opaque negotiations, and more agonizing delays. The only certainty is continued uncertainty, leaving us with lingering questions about whose interests are truly being served in this multi-billion dollar standoff, and whether true reform will ever truly come, or if it’s merely a mirage in the desert of D.C. politics.