Hold onto your hats, investors, because the latest maneuver from Japanese behemoth SoftBank Group isn’t just a ripple; it’s a seismic shockwave designed to send tremors through the already jittery global AI market. In a move that has left analysts scratching their heads and retail investors scrambling for answers, SoftBank has unceremoniously dumped its entire $5.83 billion stake in U.S. chip darling Nvidia. The immediate fallout? SoftBank’s own shares plunged by a staggering 10% – a clear signal that the market is far from convinced by this high-stakes gamble.

SoftBank’s Shockwave: Dumping Nvidia and The AI Market’s Reckoning

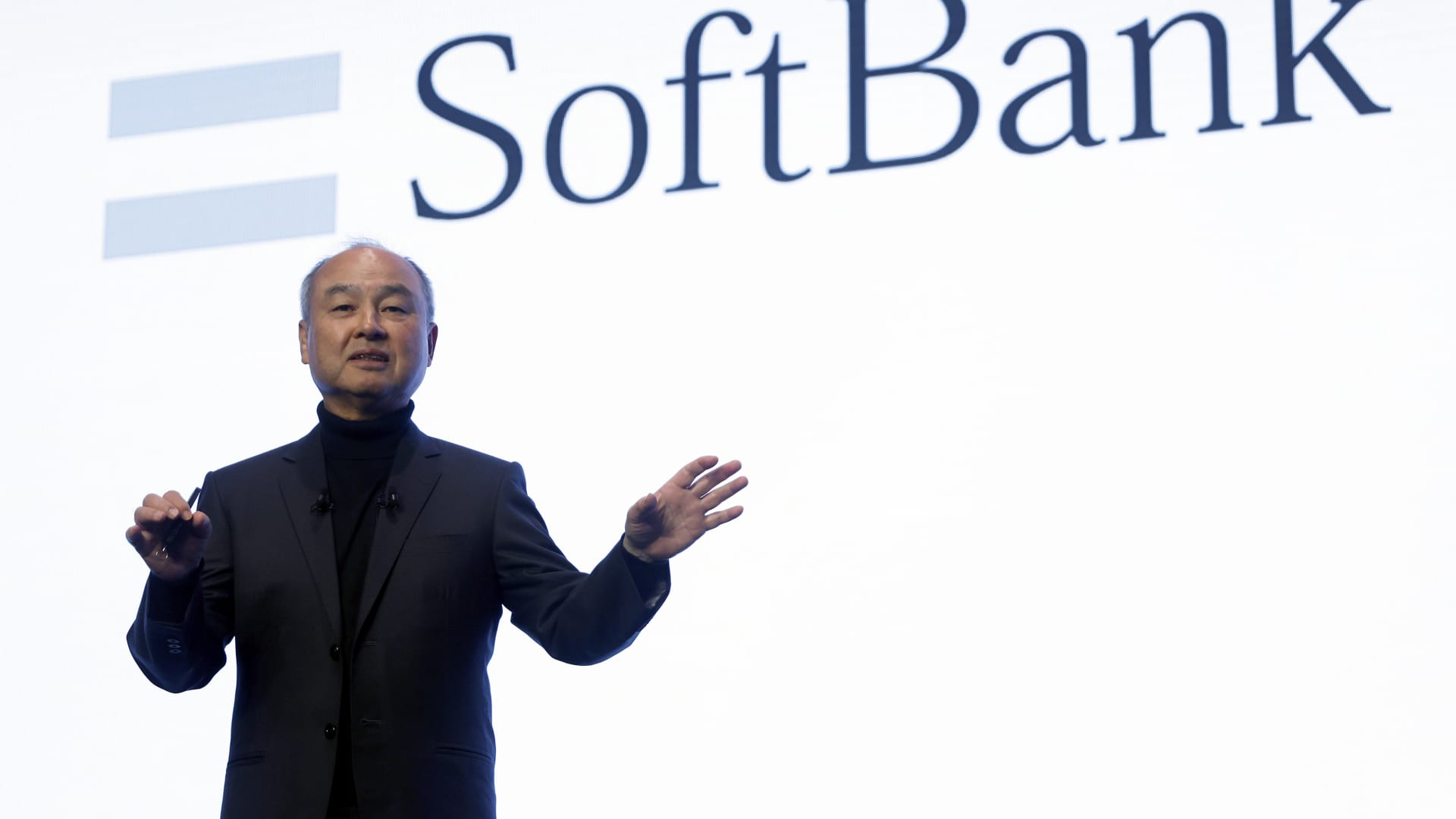

Let’s not mince words: this isn’t just a routine portfolio adjustment. This is SoftBank, under the often-eccentric leadership of Masayoshi Son, pulling the rug out from under one of the perceived cornerstones of the artificial intelligence revolution. Nvidia, the undisputed king of AI hardware, the company whose chips power everything from advanced data centers to autonomous vehicles, has been unceremoniously ditched. And the stated reason? To fund future investments in, you guessed it, AI-related endeavors, specifically hinting at deeper ties with OpenAI.

The irony is so thick you could cut it with a silicon wafer. SoftBank is selling its stake in the company that provides the foundational infrastructure for AI to invest in a company that builds *on* that infrastructure. It’s like selling your gold mine to buy shares in a company that processes gold. Is this visionary genius, or a colossal misstep born of hubris and a notoriously short attention span for long-term investments that aren’t immediately yielding astronomical returns?

Masayoshi Son’s Gamble: Genius or Jester in the AI Arena?

Masayoshi Son’s reputation precedes him. He’s the man who turned a tiny investment in Alibaba into one of history’s greatest venture capital coups. He’s also the architect of the Vision Fund, a vehicle notorious for its sky-high valuations, its audacious bets on ‘disruptors,’ and its equally spectacular write-downs. We’ve seen Son pivot, pivot, and pivot again, chasing the ‘next big thing’ with an almost religious fervor. But this time, the stakes feel different.

Nvidia wasn’t just ‘a’ tech investment for SoftBank; it was one of the crown jewels, a beacon of their AI ambitions, particularly after they famously failed to acquire ARM Holdings from Nvidia in a massive $40 billion deal. To now divest completely, especially when Nvidia’s stock has been riding the crest of the AI wave, suggests one of two things: either Son has a crystal ball no one else possesses, or he’s making a desperate play to reallocate capital amid mounting pressures and the need to prove the Vision Fund isn’t a house of cards.

Is SoftBank Signaling the Peak of the AI Bubble?

This is the question on everyone’s trembling lips. When a major player like SoftBank, with its deep insights and access to cutting-edge information, exits a prime AI asset, does it signal a lack of confidence in the short-to-medium term prospects of that asset, or even the broader sector? The market’s reaction, with SoftBank’s own shares plummeting and the broader AI-wary sentiment intensifying, certainly leans towards the former.

- Bearish Interpretation: Son sees the writing on the wall. He believes Nvidia’s current valuation has reached its apex, perhaps even venturing into unsustainable bubble territory, and it’s time to cash out before a painful correction. This is ‘smart money’ making a tactical retreat, leaving retail investors holding the bag.

- Bullish Interpretation (for SoftBank, at least): This isn’t a retreat, but a strategic reallocation. Son is doubling down on a different facet of AI, believing that the future value creation lies not in the hardware (Nvidia) but in the advanced software and models (OpenAI). It’s a calculated shift from picks and shovels to the prospectors themselves.

Which narrative is true? The market seems to be betting on the ‘peak’ theory, or at least expressing deep skepticism about the wisdom of exchanging a proven, tangible asset like Nvidia for the still-emerging, albeit dazzling, promise of OpenAI’s monetization potential.

The OpenAI Connection: A New Messiah for SoftBank?

The whisper is that the $5.83 billion raised will grease the wheels for SoftBank’s deeper involvement with OpenAI, potentially through investments in related ventures or direct stakes. OpenAI, the company behind ChatGPT, has captured the world’s imagination and ignited the latest phase of the AI gold rush. But investing in OpenAI is not without its own considerable risks.

Unlike Nvidia, a company with established revenue streams, massive market share, and a relatively clear business model, OpenAI’s path to sustained, enormous profitability is still being forged. It’s a high-burn, high-potential entity, relying heavily on ongoing innovation and market adoption. For SoftBank to swap a position in a profitable, hardware-dominant AI leader for a significant bet on an AI software/services company, it signifies a profound strategic shift. Is Son betting on a future where proprietary models and AI services generate exponentially more value than the underlying hardware, or is he simply chasing the newest shiny object, blinded by the hype?

Nvidia’s Future: Unscathed or Unsettled?

Nvidia is a titan. Its chips are indispensable. Its ecosystem, CUDA, is a formidable moat. Can SoftBank’s exit truly unsettle such a colossus? In the short term, the optics are undeniably bad. A major institutional investor, one known for its bold tech bets, bailing out creates a perception of vulnerability.

However, Nvidia’s fundamentals remain robust. Demand for its AI GPUs continues to outstrip supply, and its technological lead is substantial. But sentiment is a powerful force in markets. If other institutional investors interpret SoftBank’s move as a signal to de-risk their own AI hardware exposure, Nvidia could face headwinds that have nothing to do with its actual performance and everything to do with herd mentality and market anxiety. The question is, how many other ‘smart money’ players will follow Son’s lead, if they haven’t already done so quietly?

The Broader AI Investment Landscape: A House of Cards?

This isn’t just about SoftBank and Nvidia; it’s a stark reminder of the fragile state of the current AI investment boom. Are we witnessing a repeat of the dot-com bubble, where irrational exuberance drives valuations to unsustainable heights, only for a handful of visionary companies to survive the inevitable bust? SoftBank, with its history of both dizzying highs and gut-wrenching lows, often acts as a barometer for market sentiment in the tech sector.

Their latest move has amplified investor anxieties across the board. The sheer capital required for AI development, the intense competition, and the nascent stage of monetization for many AI applications make it a volatile landscape. When a player as significant as SoftBank makes such a dramatic pivot, it forces everyone to re-evaluate their own positions. Is the music about to stop, or is this just a momentary pause before the next frenzied dance?

Unpacking the “Spicy” Truth: Why This Matters More Than You Think

This isn’t just a financial transaction; it’s a statement. It’s Masayoshi Son, once again, staking his claim as a maverick, challenging conventional wisdom, and daring to go where others fear to tread. But unlike his early Alibaba days, the world is watching with a much more critical eye. The Vision Fund’s patchy performance has eroded some of that unshakeable faith in Son’s Midas touch.

The “spicy” truth here is that SoftBank’s move injects a potent dose of uncertainty into an already overheated sector. It forces us to ask tough questions about the sustainability of current AI valuations, the true strategic vision of one of the world’s largest tech investors, and whether the average investor is being led down a garden path by hype. It’s a high-stakes poker game, and right now, SoftBank has just shown a hand that has everyone else at the table second-guessing their own cards. Are they bluffing, or do they know something we don’t? The answer will likely dictate the fate of billions, and perhaps, the direction of the AI revolution itself. The market has reacted, but the true consequences of this audacious move are only just beginning to unfold, leaving a trail of questions and a distinct smell of fear and opportunity in the air.

SoftBank cashes out $5.8B in Nvidia, sending markets into a tailspin. Is Masayoshi Son a genius playing 4D chess, or is this the ultimate ‘sell high’ signal before the AI bubble bursts? Your portfolio NEEDS to know. #SoftBank #Nvidia #AIBubble #MarketPanic