The Deconstruction of a Final Four: Pitt vs. Texas A&M as a Case Study in College Sports Economics

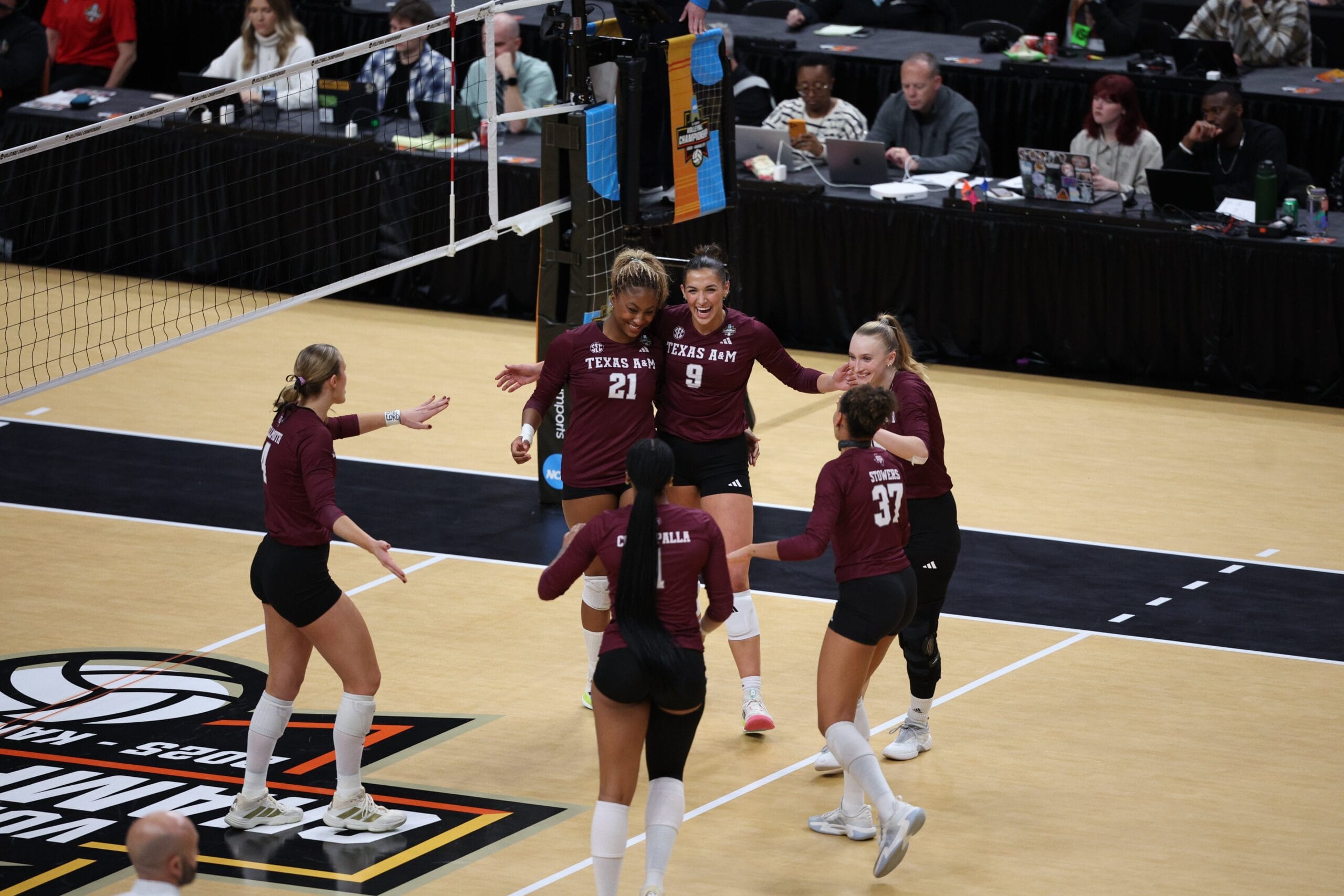

In the high-stakes world of NCAA athletics, where budgets rival small nations and brand visibility is king, it’s easy to mistake a compelling sports story for a business narrative. When the NCAA volleyball Final Four tips off at the T-Mobile Center, featuring Texas A&M facing off against Pitt, the surface-level narrative will focus on the athletes, the coaches, and the sheer grit required to reach this stage. The media will inevitably play up the human interest angle, perhaps focusing on the bond between players like Pitt’s Olivia Babcock and Texas A&M’s Logan Lednicky, who share history on the Team USA junior circuit. It’s a clean, consumable narrative, tailor-made for broadcast. But a deeper analysis reveals something far more interesting, and perhaps far more cynical, about the nature of modern college sports: a collision between two very different models of athletic program building, one driven by focused strategic investment and the other by overwhelming financial might.

The Aggie Paradox: When Football Money Buys Volleyball Success

Texas A&M’s presence in the Final Four is less a Cinderella story and more a calculated, high-leverage business maneuver by an institution known for having one of the largest athletic budgets in the nation. This isn’t just about winning; it’s about validating the ‘Aggie brand’ across all sports, ensuring that the athletic department’s massive financial footprint casts a shadow well beyond the football field. While A&M has always invested heavily in its athletic program, often with budgets that dwarf other schools in non-revenue sports, their success in volleyball hasn’t always matched their spending. This Final Four appearance represents the payoff on that investment, a strategic move to diversify their athletic portfolio and generate positive press for a program that sometimes struggles under the weight of expectations created by its own financial resources. The A&M model is simple, if blunt: spend enough money, hire top talent, build state-of-the-art facilities, and eventually, success will be bought.

The core of this strategy lies in leveraging resources from the massive revenue-generating engine—football. A&M’s athletic department is a financial behemoth, constantly seeking new ways to justify its existence and expand its influence. A Final Four berth in volleyball serves multiple purposes: it energizes the donor base, it provides fodder for recruiting in other sports, and it proves that A&M isn’t just a one-trick pony. This isn’t about passion for the sport of volleyball; it’s about strategic market positioning. The media loves to frame this as a story of heart and determination, and while those elements are present in every athlete, we must acknowledge the underlying financial reality. Texas A&M’s success in non-revenue sports often comes down to its ability to outspend competitors, out-resource, and out-recruiting competition through sheer financial muscle. It’s an important distinction to make when analyzing the new landscape of NCAA sports, where the lines between amateur athletics and professional business blur further with every passing season.

It’s important to look at the historical context here. For decades, traditional powerhouses like Nebraska, Stanford, and Penn State dominated women’s volleyball through sustained program building and deep-rooted community support. These programs developed a legacy that transcended individual players or specific budgets. But with the advent of massive conference realignments and the explosion of NIL (Name, Image, and Likeness) deals, the playing field has tilted dramatically toward schools like A&M that possess vast, untapped financial reserves. The Final Four appearance is a direct consequence of this shift. It shows that a school can essentially buy its way into the conversation in a non-revenue sport, challenging the old guard that built its success on a foundation of tradition and long-term investment rather than short-term financial boosts.

Pitt’s Programmatic Discipline: A Contrasting Philosophy

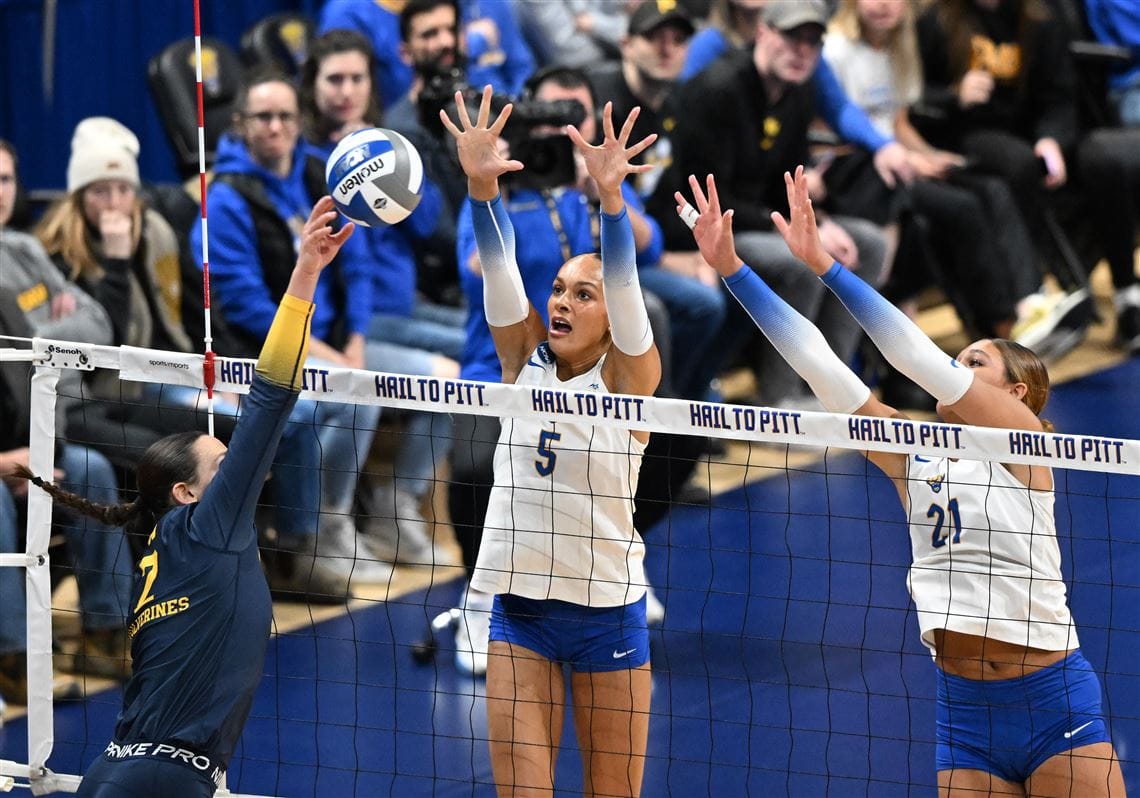

In stark contrast to Texas A&M’s ‘big spending’ model, Pitt represents a more focused, disciplined approach to program building. Pitt has established itself as a consistent force in NCAA volleyball, achieving multiple Final Four appearances in recent years. This success isn’t just a blip on the radar; it’s a testament to a strategic decision to prioritize volleyball within the athletic department, even though Pitt is not in the same financial stratosphere as A&M or other SEC heavyweights. Pitt’s success demonstrates that consistent coaching, strategic recruiting, and cultivating a distinct program culture can compete effectively with the financial might of the larger institutions. They have effectively punched above their weight class by maximizing their resources and establishing a strong identity within the ACC.

Pitt’s journey to this stage highlights the importance of institutional commitment and stable leadership. Unlike A&M, where a new coach might come in with a massive war chest and be expected to deliver immediate results, Pitt built its success more organically. This approach, which focuses on developing talent over multiple years and creating a cohesive team dynamic, is far more sustainable in the long run. When we analyze the specific matchup, we’re not just looking at two teams playing volleyball; we’re witnessing a clash of philosophies. Pitt’s model argues that focused strategic investment in a single sport, rather than broad, generalized spending across an entire athletic department, yields better results when facing the behemoths of the SEC. The program’s success is a counter-argument to the idea that money is the only factor in winning championships. But in the age of NIL, how long can this smaller, more focused model hold up against the sheer purchasing power of schools like A&M?

The Final Four clash between these two institutions, therefore, is more than just a volleyball match. It’s a barometer for the future direction of non-revenue sports in the NCAA. If Texas A&M, with its recent, heavy investments, can rapidly find success, it signals a potentially worrying trend for smaller programs that have built their legacy on hard work and consistency. Pitt’s model—disciplined, deliberate, and sustained—is a challenge to this new ‘pay-to-play’ mentality. The game itself will be compelling, but the underlying narrative—the battle of different economic philosophies—is arguably more significant for the future of college athletics as a whole. The Final Four isn’t just about who wins; it’s about which model for building success ultimately prevails in this evolving landscape.

The Broader implications: Media Attention and the Future of Volleyball

The media coverage of this event, specifically its inclusion on ESPN, underscores a larger trend: the increasing commercial viability of non-revenue sports. The NCAA and its broadcast partners are continuously looking for new inventory to fill programming slots and attract eyeballs during traditionally slower periods. Volleyball, with its fast-paced action and growing fan base, has become a prime candidate for expansion. But this attention comes with a cost. As more money pours into the sport, either through media contracts or direct institutional investment from schools like Texas A&M, the competitive balance shifts dramatically.

The Final Four isn’t just about the teams; it’s about the business of college athletics. The shift toward a ‘T-Mobile Center’ and prime-time ESPN slots for volleyball signals that the sport is moving into the mainstream, bringing with it all the complications that follow. This includes the pressure on coaches to win immediately, the increasing importance of recruiting transfers via NIL, and the potential for a widening gap between the ‘haves’ and ‘have-nots’ within the sport. The Final Four matchup between Pitt and A&M provides a unique snapshot of this transition. Pitt represents the old guard (though a relatively new powerhouse within that guard) that built success methodically. Texas A&M represents the new guard, using massive financial resources to accelerate the process. The question remains: as the sport grows in popularity, will it create more opportunities for smaller schools to succeed, or will it simply consolidate power among the wealthiest institutions, turning volleyball into another arm of the ‘football industrial complex’? The logical deconstructor knows that money, in the end, usually wins. This Final Four is merely a high-stakes demonstration of that truth, in a very real sense, a new era where athletic success can be purchased and branded, rather than solely earned through long-term effort. We are watching the future unfold, and it looks increasingly like an auction.