The Sleeping Giant Awakes: Understanding Silver’s Dual Identity Crisis

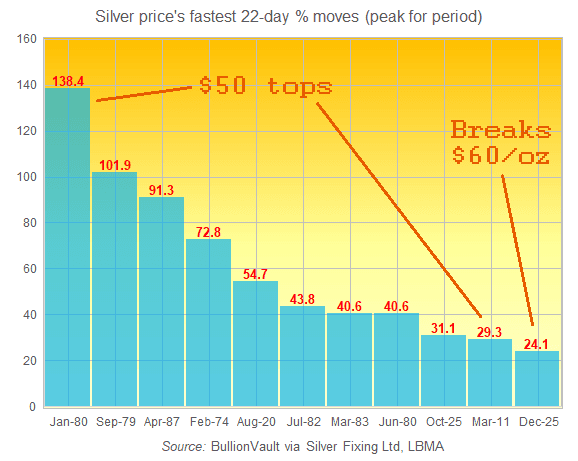

It’s a common refrain among market pundits to call silver ‘the sleeping beauty’ of precious metals, and for decades, that moniker seemed accurate. But the recent surge, which saw prices shatter records and push past the $60 mark, suggests the sleeping beauty has not only woken up but is ready to throw down. What we’re witnessing isn’t just a cyclical bounce in a volatile commodity; this is a fundamental revaluation driven by a collision between two distinct, powerful forces: the green industrial revolution and the terminal decline of fiat currency.

The core of silver’s historical identity crisis lies in its ‘dual nature.’ Unlike gold, which is almost exclusively a store of value and adornment, silver serves two masters. First, it acts as a monetary metal, a historical form of currency that has been used alongside gold for millennia. But secondly, it is a crucial industrial component, used in everything from solar panels to high-tech electronics, and increasingly, in critical infrastructure like AI data centers. Because of this split personality, silver has often been ignored by both mainstream industrial investors (who see it as too volatile) and mainstream monetary investors (who see it as too industrial). And yet, this exact dynamic is why silver is currently setting itself up for a historic short squeeze.

The Shortage Story: Why Industrial Demand is Non-Negotiable

Let’s unpack the industrial side first. The demand for silver from the technology industry is inelastic, meaning price changes don’t significantly reduce consumption when a particular component is critical. You can’t make a solar panel without silver paste; you can’t build a high-speed semiconductor without silver connections. And because the global push for decarbonization and electrification is gathering pace, the demand for silver in these applications is accelerating rapidly. The input data highlights a crucial point: the ‘shortage story’ is combining with the price feedback loop to create a perfect storm. Because there is a physical shortage of silver, industrial users are forced to pay higher prices, which in turn fuels the narrative of scarcity, attracting monetary investors, which then further tightens the physical market. It’s a feedback loop that has only just begun to unwind.

But the real kicker here is that the global physical inventory of silver, particularly in major vaults like the COMEX, is dwindling at an alarming rate. The ‘paper price’ of silver, determined by futures contracts on exchanges, is often a completely detached entity from the physical reality on the ground. The current setup allows massive institutions to short (bet against) silver on paper, even when there isn’t enough physical metal to fulfill those paper claims. The problem arises when industrial demand for physical silver forces a default on these paper promises. And because every single solar panel, every electric vehicle, every new AI server farm needs silver, the industrial demand provides a non-negotiable floor under the physical price. The industrial tailwind is far stronger than any short-term futures market manipulation, creating a situation where the paper shorts are essentially playing with fire in a room full of gunpowder.

The Fiat Debasement Thesis: Silver as Monetary Insurance

Now, let’s look at the other side of silver’s identity: its role as a monetary metal. The input data mentions a key factor: the expectation of US Federal Reserve interest rate cuts. This is crucial for understanding the psychology of precious metals. When central banks cut rates or hold them steady at low levels, they are essentially signaling a policy of debasement. Lower interest rates decrease the incentive to hold cash (the US dollar) because the purchasing power of that cash erodes faster over time. Because of this, investors naturally seek refuge in assets that cannot be printed, like gold and silver. And because silver is significantly cheaper than gold on a per-ounce basis, it tends to attract a broader base of investors when the monetary thesis takes hold.

The historical context of silver’s monetary role is vital here. For centuries, silver was the backbone of global commerce alongside gold. It was only in the late 19th and early 20th centuries that silver was systematically demonetized by Western governments, culminating in the ‘Crime of ’73’ in the US, which formally adopted a single gold standard and essentially marginalized silver from its primary role as currency. This historical demonetization is why silver has traded at such a steep discount to gold for over a century. But as the world now questions the sustainability of pure fiat currency systems and seeks alternatives to the US dollar hegemony (especially with BRICS nations looking to create commodity-backed alternatives), silver’s role as a store of value is regaining legitimacy. The recent price action suggests that the market is beginning to price in a future where silver’s monetary value is once again a primary driver.

Looking Ahead: Triple-Digit Predictions and the Industrial Catalyst

The input data asks about triple-digit silver, and from a cold strategist perspective, this isn’t just a fantasy; it’s a near certainty if the current structural trends continue. The supply side of the equation is constrained by decreasing ore grades in existing mines and a lack of new discoveries. Silver mining is often a byproduct of base metal mining (like copper or lead), so a direct increase in silver production is difficult to achieve without a significant increase in base metal mining, which itself faces permitting and environmental hurdles. The industrial demand, on the other hand, is accelerating exponentially due to the green transition. This creates a supply-demand mismatch that will naturally force prices higher.

When you layer the industrial scarcity on top of the monetary debasement thesis, you get a powerful combination. The market is effectively being squeezed from both sides. And because silver’s price movements are historically more volatile than gold’s (it has a higher beta), once a breakout occurs, it tends to move violently. The initial surge above $60 is merely the beginning of this explosive revaluation. The real price discovery will happen when the industrial users and monetary investors truly realize they are competing for a limited, shrinking pool of physical metal. The move to triple-digits isn’t a prediction; it’s a mathematical necessity given the current economic and industrial paradigm.

And let’s not forget the geopolitical angle. As countries like China and Russia increase their reserves of physical commodities and reduce their reliance on the US dollar, physical precious metals become increasingly valuable as tools of geopolitical leverage. This adds another layer of demand that is completely divorced from Western financial market dynamics. The shift in global financial architecture from a unipolar, fiat-backed system to a multipolar, resource-backed system positions silver, with its crucial industrial and monetary roles, as a potential cornerstone of future value exchange. The sleeping beauty isn’t just awake; she’s about to redefine the entire financial system, outdated financial system.