The End of an Era, The Start of a Stratification

Let us be perfectly clear. The announcement that Micron is shuttering its consumer-facing brand, Crucial, is not the story of a simple corporate restructuring. It is not about synergy or streamlining. This is a public declaration of a new world order in the semiconductor industry. It is the cold, hard, and entirely predictable consequence of a paradigm shift so massive that it is reordering global priorities. And the individual consumer, the hobbyist, the PC builder who painstakingly assembled their own machine piece by piece? They have just been officially relegated to the bottom of the food chain, left to fight for the silicon scraps falling from the banquet tables of the AI hyperscalers. This is not malice. It is something far colder. It is pure, unadulterated economic calculus.

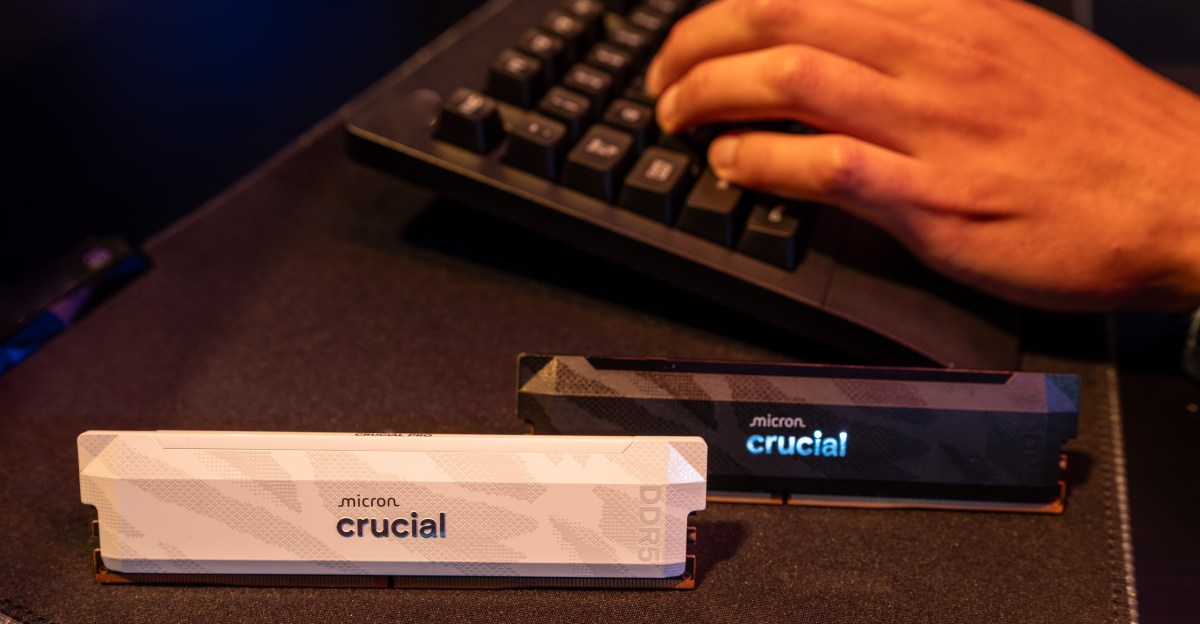

For decades, a delicate symbiosis existed. The consumer market, with its endless demand for faster gaming rigs, more responsive workstations, and ever-larger storage drives, served a crucial purpose for semiconductor giants like Micron. It was a high-volume, albeit low-margin, outlet for their production. But more importantly, it was a proving ground and a way to monetize silicon wafers that weren’t quite perfect enough for the punishing demands of enterprise servers. The Crucial brand was the embodiment of this relationship—reliable, affordable, and accessible. It was the bedrock of the DIY PC revolution, empowering a generation to understand the guts of their machines and to build powerful computers for a fraction of the cost of pre-built systems from Dell or HP. It democratized power. That is all over.

A Foundation Built on Tolerated Scraps

From a strategic perspective, the consumer market was always a messy, frustrating affair. It meant dealing with millions of individual customers, managing complex retail channels, processing returns, and spending fortunes on marketing to people who measured performance in frames-per-second instead of teraflops. It was a necessary hassle. Because the real money, the quiet, consistent profit, was always in the enterprise sector—selling in bulk to server farms and businesses with billion-dollar budgets. The consumer division was the loud, flashy opening act for the main event taking place in boring, beige data centers. And now, the main event has become so overwhelmingly profitable that the opening act has been canceled. Permanently.

The AI Tsunami: A Force of Creative Destruction

The catalyst for this brutal pivot can be described in two letters: AI. But understanding the magnitude of this shift requires looking past the buzzwords. The large language models and generative AI platforms that have captured the world’s imagination are not just clever software; they are voracious, insatiable beasts that consume computational resources on a scale previously unimaginable. And their primary food is a specialized type of memory known as High Bandwidth Memory, or HBM. This is not the same DDR5 stick you snap into your motherboard. HBM involves stacking DRAM chips vertically and connecting them directly to a GPU, like NVIDIA’s H100, creating an information superhighway that allows the processor to access massive amounts of data almost instantaneously. It’s the secret sauce behind AI’s magic. It is also astronomically profitable.

And because the manufacturing process for HBM is so complex and requires the absolute highest-grade silicon wafers and the most advanced fabrication techniques, it directly cannibalizes the production capacity that would have otherwise been used for top-tier consumer products. Every pristine wafer that could have become a cutting-edge Crucial SSD or a high-speed kit of DDR5 RAM is now being diverted to the HBM production line. Why? Because a single HBM stack sold to an AI giant can generate more profit than an entire pallet of consumer SSDs. The math is not just compelling; it’s absolute. From the sterile environment of a corporate boardroom, this is not a choice. It is an obligation to the shareholder.

The Cold, Hard Numbers of Abandonment

Micron’s leadership did not make this decision over a weekend. This was the result of years of forecasting. They saw the explosion in data center construction, they understood the exponential growth in demand for AI training hardware, and they looked at their limited fabrication capacity. They were faced with a strategic fork in the road. Path A involved continuing to invest in the consumer market—a fragmented, low-margin battlefield where they compete with Samsung, SK Hynix, and a dozen other brands for the privilege of selling a $100 SSD. Path B involved dedicating all their prime resources to serving a handful of colossal, cash-rich clients who are desperate for HBM and are willing to sign multi-billion dollar contracts to secure their supply chain. What choice did they really have? They chose to exit a war of attrition to focus on a gold rush. Anyone surprised by this has not been paying attention to the fundamental laws of capitalism.

The Fallout: A Barren Landscape for the Power User

The consequences for the consumer and the DIY PC enthusiast will be stark and immediate. First, choice evaporates. With a major player like Micron exiting the field, the remaining manufacturers face less competition. This gives them pricing power. Expect the cost of high-performance RAM and SSDs to climb, not because of a genuine shortage, but because of a calculated consolidation of the market. Why would Samsung or Hynix engage in a price war when one of their main rivals has voluntarily surrendered? Second, innovation will bifurcate. All the revolutionary R&D, the bleeding-edge development, will be focused on the enterprise and AI sectors. The consumer market will receive watered-down, trickle-down technology years after it has been deployed in data centers. The gap between what a corporation can buy and what an individual can build will widen from a gap into an unbridgeable chasm. The golden age of being able to build a home computer that could rival a professional workstation is definitively over. You will be building with leftovers.

The New Feudalism of Technology

Ultimately, Micron’s retreat from the consumer space is more than just a business decision; it is a symptom of a larger consolidation of power. The era of decentralized, democratized computing is being replaced by a new technological feudalism. In this new model, immense computational power is not owned by individuals but is concentrated in the hands of a few tech lords—the Googles, Amazons, and Microsofts of the world. We, the consumers, will no longer be owners of powerful hardware but will become tenants, renting access to AI services from the cloud. Micron is simply aligning its production with this new reality. They are no longer in the business of selling components to build personal castles; they are now exclusively in the business of supplying the bricks to build the imperial palaces. Crucial’s death is not a tragedy; it is a historical marker, the point at which the industry stopped pretending the consumer was king.