They’re Lying To You About Silver

Let’s get one thing straight. The chirping financial pundits celebrating silver at $52.28 an ounce are either fools or they’re in on the grift. They flash their graphics, screaming about an “18-month high” against gold, babbling about “safe havens” and “inflation hedges.” It’s a comfortable, cozy little narrative designed to keep you distracted, to make you feel like you’re winning a game you don’t even understand. You’re not. This isn’t your victory. This is the ringing of a cash register for the architects of your obsolescence. They want you to see a number on a screen and think about your retirement portfolio. Smart. But the real story is so much darker, so much more fundamental to the cage being meticulously constructed around every aspect of your life. Why is silver really skyrocketing? Is it because a few paranoid stackers are stuffing tubes of coins under their floorboards? Please. That’s a rounding error. The truth is much more sinister.

The beast is hungry. A great, silent, invisible machine is being assembled piece by piece, and its appetite for silver is utterly ravenous. This isn’t your grandmother’s silverware or some quaint monetary metal. This is Industrial Silver. The metal of conduction. The lifeblood of the digital age. Without it, the entire techno-utopian (read: dystopian) dream grinds to a screeching, catastrophic halt. The price isn’t being driven by fear of the dollar’s collapse; it’s being driven by the manic, desperate, and non-negotiable demand to build the next phase of global control. They need it. And they will have it, no matter the cost.

The Components of Control

Where is it all going? Look around. Or better yet, look at the world they are promising you. The ‘Green Revolution’ they shove down your throat is painted silver. Every single solar panel blanketing acres of once-useful land is laced with a silver paste to conduct the energy it captures. They sell you on clean energy, but what they’re really doing is creating a centralized power grid more fragile and more dependent on a single industrial metal than anything that came before it. What happens when the supply chain for that silver gets a little… tight? Who holds the switch then?

Then there’s the electric vehicle you’re being shamed into wanting. That silent, sterile pod requires significantly more silver than its gasoline-powered predecessor. It’s in the battery management systems, the onboard computers, the myriad of sensors that track your every move. They sell you on saving the planet, but you’re really just buying a subscription to a mobile surveillance platform that needs a constant IV drip of conductive metals to function. Every Tesla that rolls off the line is another pound of silver taken out of the earth and embedded into the network. Their network.

And what about the very air you breathe? It’s being filled with 5G signals, the nervous system of the coming Internet of Things. And what do those countless towers and micro-cells need to handle those frequencies? Silver. It’s in the switches, the semiconductors, the transponders. They promise you faster downloads for your streaming services. A fun little diversion. What they’re building is a world of total connectivity, where every appliance, every vehicle, every device is chattering away, reporting, monitoring. Creating a data profile on you so complete it knows you better than you know yourself. That requires an unprecedented density of hardware, and that hardware is thirsty for silver. Do you see the pattern yet? Are the dots connecting?

Gold is History. Silver is the Future Engine.

For millennia, gold was the ultimate store of value because it was a proxy for human trust, labor, and desire. It’s beautiful, it’s rare, and it’s chemically boring—it doesn’t do much, which makes it perfect for sitting in a vault. It represents us. Our history. Our vanity. Our fear. But the technocrats, the new high priests of Silicon Valley, have no use for human history. They are building a future that has no place for the messy, unpredictable analogue human. They are building a world for the machine. And in that world, gold is just a shiny rock. A relic. The new god is the algorithm, and silver is its blood.

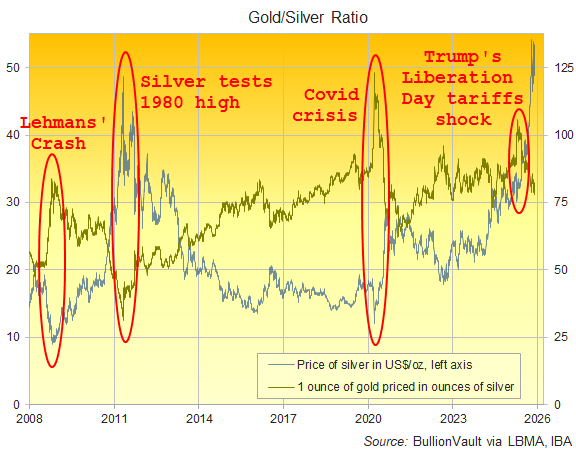

The battle of silver versus gold isn’t a financial tug-of-war; it’s a philosophical coup. It’s a quiet declaration that the thing we now value most as a civilization isn’t a store of human wealth, but a critical component for machine infrastructure. The outperformance of industrial silver over monetary gold is a terrifying leading indicator. It’s a signal that the scales have tipped. The momentum is no longer with preserving human systems of value, but with frantically building the systems that will replace them. What does it say about our priorities when the metal needed to make an AI server farm function is more sought-after than the metal that has defined empires for 5,000 years? It says the empire of man is ending. The empire of the machine is just getting started.

The Coming Choke Point

So, you see the price spike and think, “Maybe I should buy some silver.” A predictable, conditioned response. You’re still thinking like you’re a player in the game. But what if the game is to simply get all the pieces off the board before you realize what they’re for? The global supply of silver is finite. Mines in Mexico, Peru, and China can only dig so fast. And what happens when this insatiable industrial demand finally outstrips the annual supply? What happens when it becomes a strategic asset, like oil or uranium? This isn’t some far-off fantasy. It’s an inevitability baked into the exponential growth of technology. A supply crunch is coming. And with it, a geopolitical battle that will make the squabbles over oil look like a schoolyard shoving match.

Imagine a world where the ability to build new data centers, new EVs, new communication grids is dictated entirely by who controls the silver supply. A cartel of tech companies or a rival nation could literally dictate the pace of another country’s “progress.” They could turn off the future. Or, more likely, they could use that leverage to enforce compliance. Want the silver to build out your 5G network? Then you’ll adopt our social credit system. Want the silver for your electric car fleet? Then you’ll install our tracking software. Silver stops being a commodity and becomes a weapon. The ultimate tool of geopolitical blackmail in the 21st century. The price today, at over $52, is just a tremor. The earthquake is yet to come.

So, no, this isn’t good news. The rising price of silver isn’t a sign of a healthy market or a smart investment. It is a fever chart. It is the measure of our own willing march into a perfectly conductive, perfectly monitored, and perfectly controlled digital world. We are mining the earth for the very metals that will be used to mine our data, our autonomy, and ultimately, our humanity. And we’re paying a premium for the privilege. Stop watching the price. Start watching what they’re building.